Weaker-than-expected economy prompts FOMC comments

Weaker-than-expected economy prompts FOMC comments

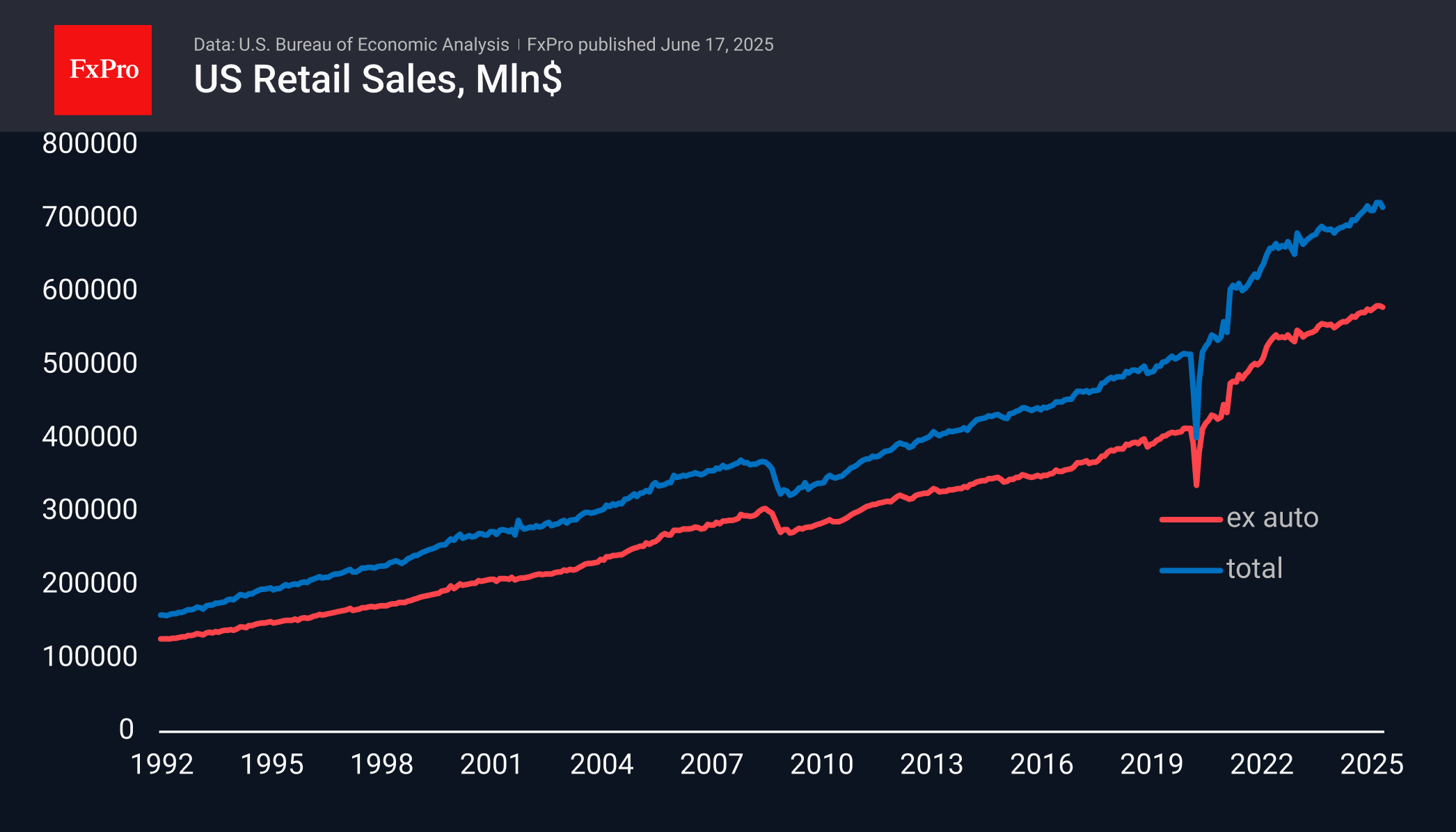

US retail sales fell 0.9% in May, returning to the level of three months ago. Economists on average had forecast a 0.7% contraction, following a 0.1% decline earlier and a 1.5% jump in March. Auto sales and lower fuel prices drive volatility. Still, there is also a worrying sign in the fall in household goods sales, where a decline in sales typically reflects Americans' shift to savings and has been associated with recessions in recent years.

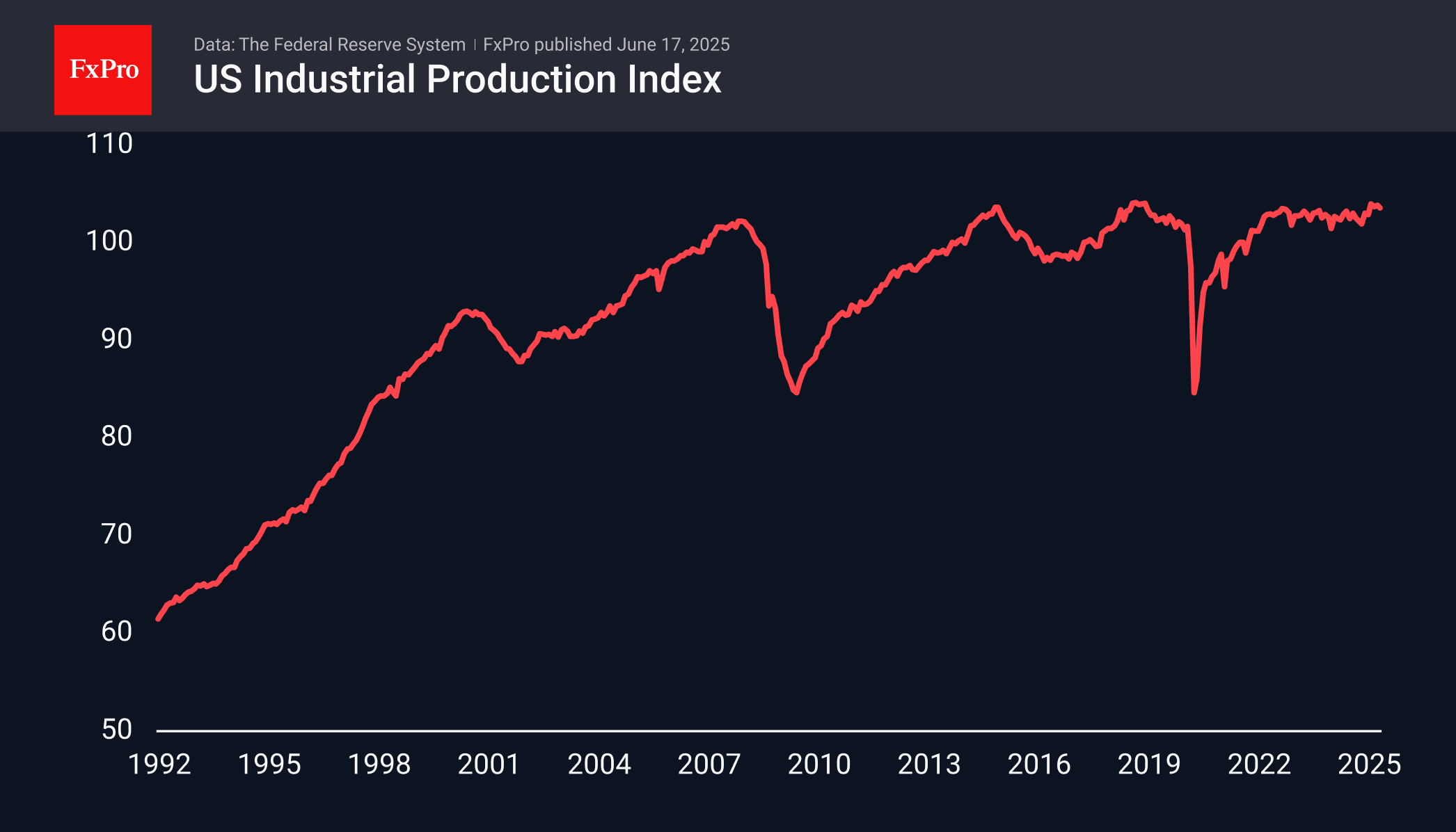

A separate Fed report noted a 0.2% decline in the industrial production index in May. The index has retreated 0.4% from its February peak, forming a reversal from the 104 area (2017=100), roughly the same area where production peaked in 2019 and 2014. Slightly lower, around 102.3, was the peak in December 2007, which makes this area a kind of ceiling for the level of industrial production, setting up another reversal of the downward trend. Fundamental factors in the form of tariff wars and a tight monetary policy strengthen the arguments in favour of a short-term decline. However, today the ball is in the court of the Fed, which will present its comments and forecasts on monetary policy and the economy in the evening. Powell's softening tone can put pressure on the dollar and support the economy in the coming quarters. The desire to "wait and see" can accelerate the correction in manufacturing and retail sales in the United States.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)