What is ahead: US PCE & Germany CPI

What is ahead: US PCE & Germany CPI

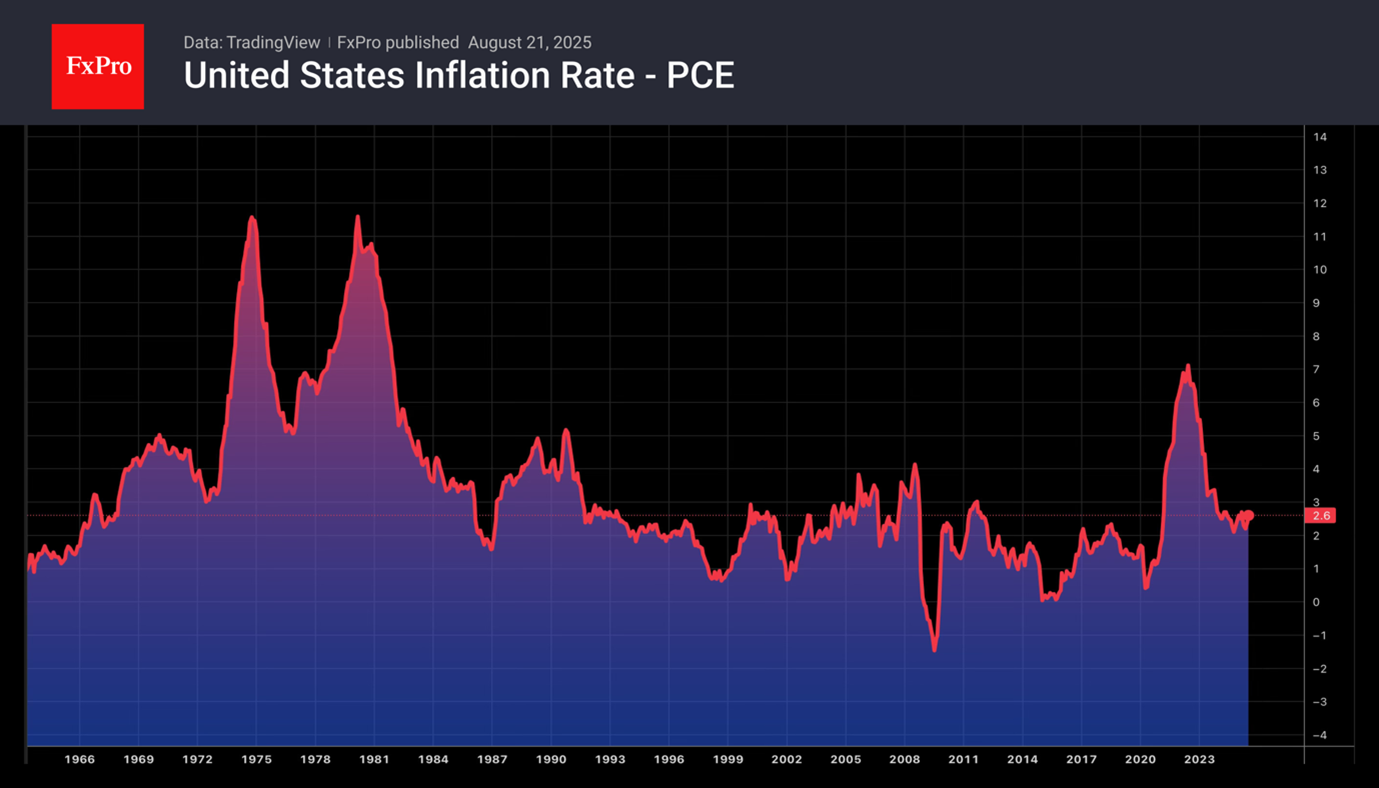

The main economic calendar events for the last week of August will be the release of data on US GDP for the second quarter, the personal consumption expenditure index, and the trade balance for July. Investors will be interested in the minutes of the last meeting of the European Central Bank and the preliminary estimate of inflation in Germany. GDP estimates will also be published for Canada and Switzerland, while consumer price data will be published for Japan.

According to Goldman Sachs estimates, the end of the Russia-Ukraine conflict will result in a 2.5% strengthening of the euro against the US dollar. The eurozone economy, which has been affected by geopolitics and the energy crisis, will receive a new impetus for growth. Its outperformance of US GDP in 2026, thanks in part to Germany's fiscal stimulus, will create a solid foundation for an upward trend in EURO USD.

Markets will be digesting Jerome Powell's speech in Jackson Hole. It will certainly seem insufficiently ‘dovish’ to Donald Trump. So don’t be surprised if the president launches yet another offensive against the Fed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)