Buyers failed to pick up on the crypto market

Market Picture

The crypto market has been under moderate but persistent pressure throughout Wednesday, losing 1.26% over the past 24 hours to $2.24 trillion. Prices of top coins are down, except for Toncoin, which adds 1.6% for the day and 19% for 30 days, and Tron (+0.4% for the day and +10% for 30 days).

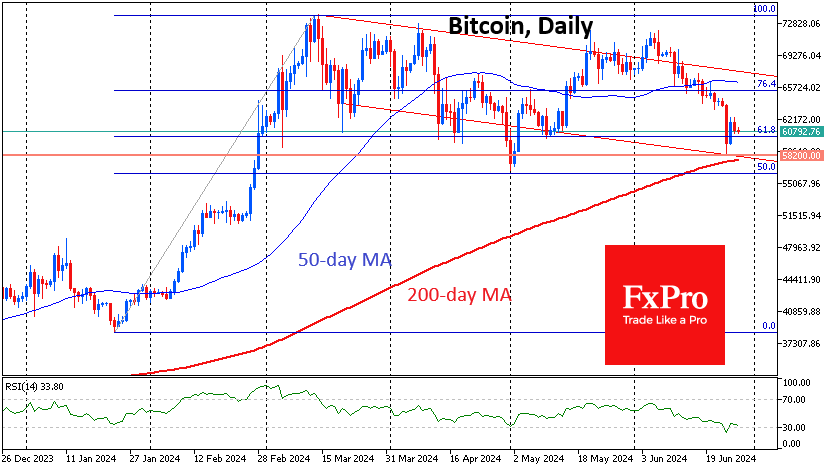

Bitcoin is trading near $60.7K, having clawed back nearly half of the rebound from Monday's lows. After the market met the long-overdue demand for spot ETFs, selling factors by miners and long-term holders began to have a noticeable impact on quotes. Also important for Bitcoin is the sentiment in global markets, where the neutral tone is replaced by neat pressure, which is also negative for the price of the first cryptocurrency.

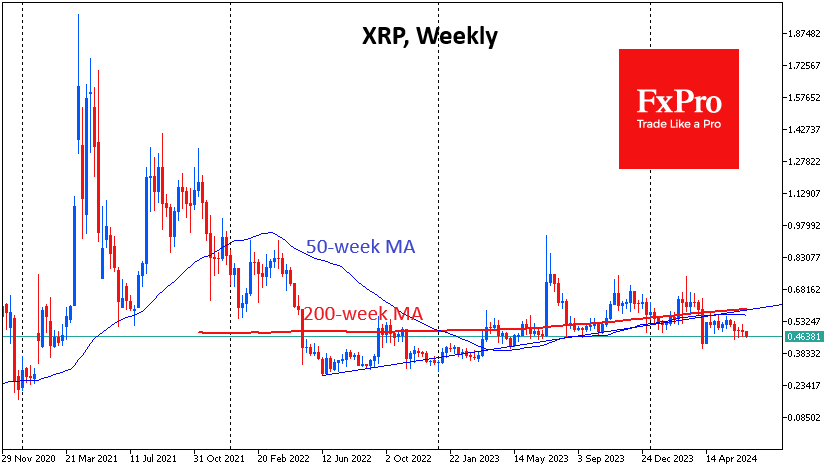

The XRP price went back to $0.4640, the area of this month's lows and a support level for the last twelve weeks. Sellers have been pushing quotes for the past five weeks. Earlier this year, the price broke key long-term support levels in the form of a trendline through the 2022 and 2023 lows and the 200 and 50-week averages. Without overall positivity in the crypto market, it could be a matter of days before the sell-off accelerates sharply.

News background

In terms of on-chain analysis, quotes have crossed the realised price level of short-term holders at $62,000, which historically can act as support during corrections in bull markets.

According to Arkham data, German authorities sent another 595 BTC worth ~$36.6 million to crypto exchanges on 26 June. Authorities began actively moving the cryptocurrency on 19 June, when some of it first hit the Kraken and Bitstamp exchanges.

Bitwise forecasts net inflows into spot ETH-ETFs in the US of $15bn in the first 18 months. Bloomberg expects trading in the new product to start on 2 July.

Solana Foundation has launched tools that enable it to turn any website or app into a gateway for cryptocurrency payments and other blockchain transactions.

On 26 June, the Blast development team completed the first phase of an airdrop, distributing 17 billion BLAST tokens (17% of the total issuance). Blast is an Ethereum-based layer 2 (L2) network that was launched in November 2023 by Blur founder under the pseudonym Pacman. In terms of blockchain value locked (TVL), the Blast ecosystem is ranked sixth in the DeFi Llama ranking with a value of $1.58bn.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)