Crypto hovering at altitude

Crypto hovering at altitude

Market picture

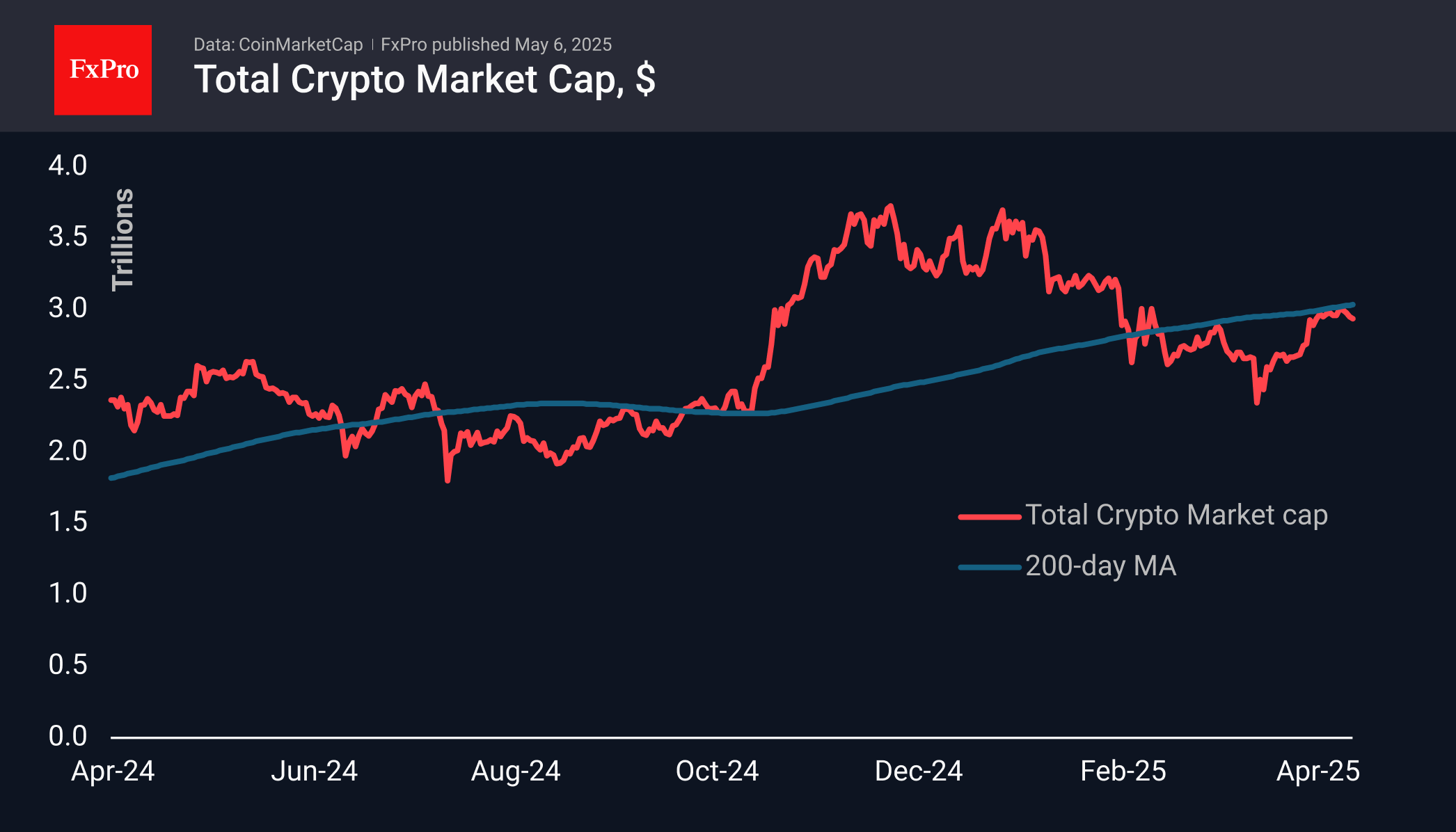

The cryptocurrency market is losing about 1%, charting a downward trend after soaring in the second half of April and plateauing at the very end of the month. With a market capitalisation of $2.94 trillion, the cryptocurrency market is just over 1% below the levels of a week ago. Among the top coins over the past seven days, anonymous Monero and zCash remain in the lead, remaining in positive territory after surging due to a hacker theft last week, which reminds us of the advantages of this type of coin.

Bitcoin, on the other hand, echoes the general mood of US stock indices, letting off steam in recent days following a surge in the second half of April. This timely cooldown after reaching overbought levels could be a healthy pause, paving the way for further gains.

XRP missed out on much of the cryptocurrency rally in late April, and it never managed to break away from its 200- and 50-day moving averages. At 2.09, XRP is trading through the important support of recent months, forcing us to keep a close eye on the direction of the breakout, as it would open the way for a 50% change from the current price. That's a huge potential.

News background

According to CoinShares, global crypto fund investments rose by a significant $2.029bn last week after inflows of $3.423bn, with bitcoin investments up $1.84bn, Ethereum up $149m, XRP up $11m, Tezos up $8m and Solana up $6m.

Ethereum is preparing for increased volatility following the Pectra hardfork on 7 May. Bollinger bands in the ETH/BTC pair have narrowed sharply in the run-up to the hardfork; the upcoming trend depends largely on the direction of the breakout, notes CoinDesk analyst Omkar Godbole.

88% of BTC supply remains in profit, with losses concentrated among buyers in the $95,000 to $100,000 range. The figure also bounced from its long-term average, indicating a broad reset of investor expectations without a large-scale capitulation, Glassnode noted.

Strategy reported an additional 1,895 BTC ($180.3 million) in purchases last week at an average price of $95,167 per coin. The company owns 555,450 BTC, which were bought at an average price of $68,550. The total investment is valued at $38.08bn.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)