EURUSD gives up gains but not bearish yet

- EURUSD switches back to losses after touching resistance

- Technical signals weaken but bears not in control yet

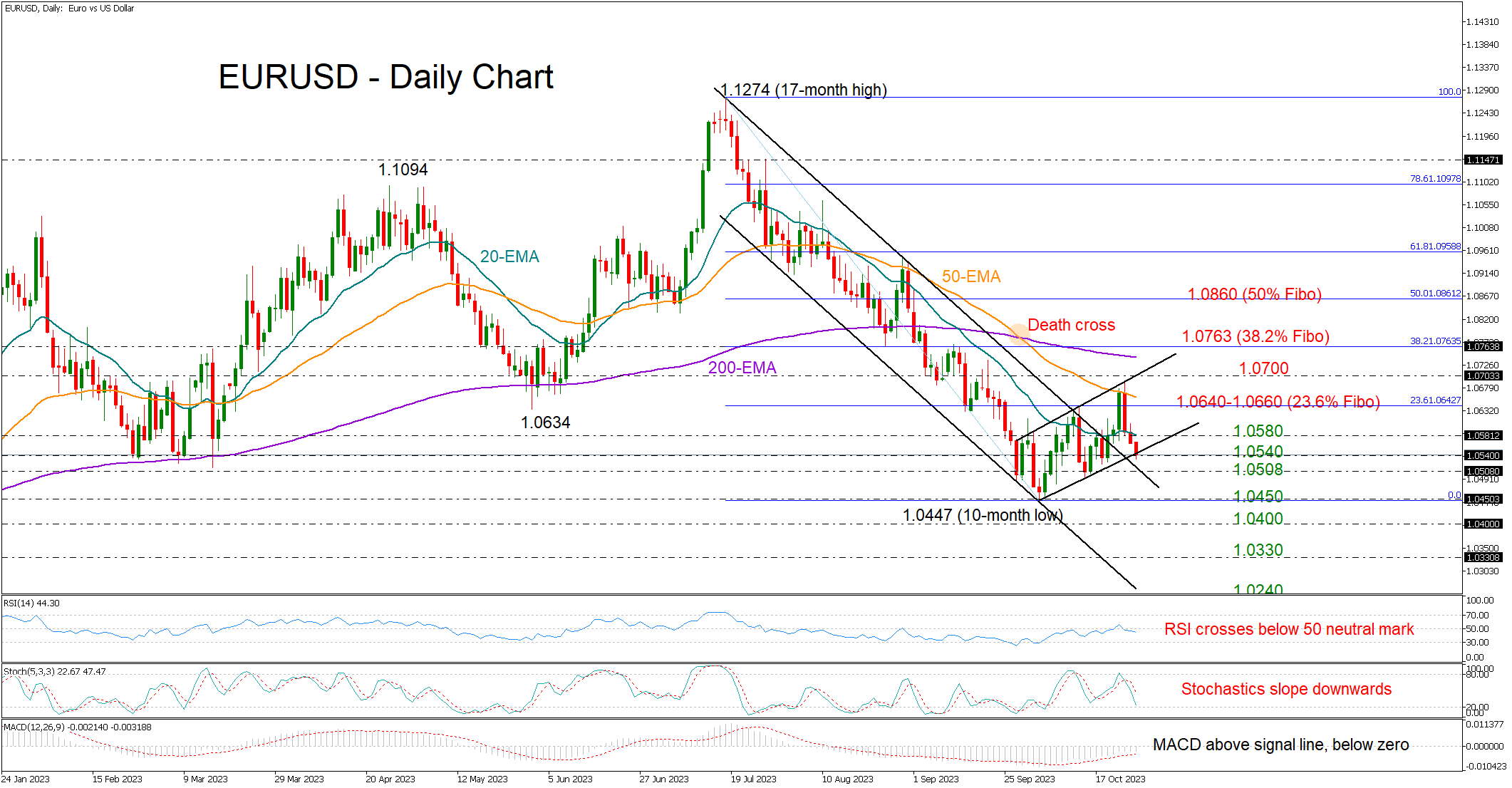

EURUSD was harshly pressured after touching its 50-day exponential moving average (EMA), erasing almost all the gains it made last week ahead of the ECB policy announcement.

The price went below its 20-day EMA, and the RSI dropped below 50, causing concerns of potential market dominance by sellers in the short-term.

On a positive note, there is a short-term bullish channel in the chart that is currently protecting against downward pressure around 1.0540. The upper band of the former bearish channel could also cease selling pressure nearby at 1.0508. If the bears breach that base, the price could tumble towards October’s low of 1.0447, while a step below 1.0400 could cause a sharp decline towards the November 2022 barrier of 1.0330.

If the price drifts higher and above the constraining 20-day EMA at 1.0584, the spotlight will turn again to the 50-day EMA, which is converging towards the 23.6% Fibonacci retracement of the latest downleg at 1.0640. A successful battle there might lift the pair towards the channel’s upper boundary at 1.0700. Still, only a decisive rally above the 200-day EMA and the 38.2% Fibonacci mark of 1.0763 would brighten the short-term outlook.

Overall, the latest aggressive pullback in EURUSD has yet to confirm a bearish bias. For that to happen, the pair will need to slide below 1.0508.

.jpg)