Robust eurozone data brought EURUSD back above 1.05

Robust eurozone data brought EURUSD back above 1.05

The single currency edged up against most of its peers on Wednesday and managed to return to territory above 1.05, helped in no small part by published economic data.

In the morning, Germany surprised with a less sharp drop in industrial production, which fell by 0.1% in October against an expected 0.6%. France's trade deficit narrowed to 12.2bn in October from 17.2bn a month earlier.

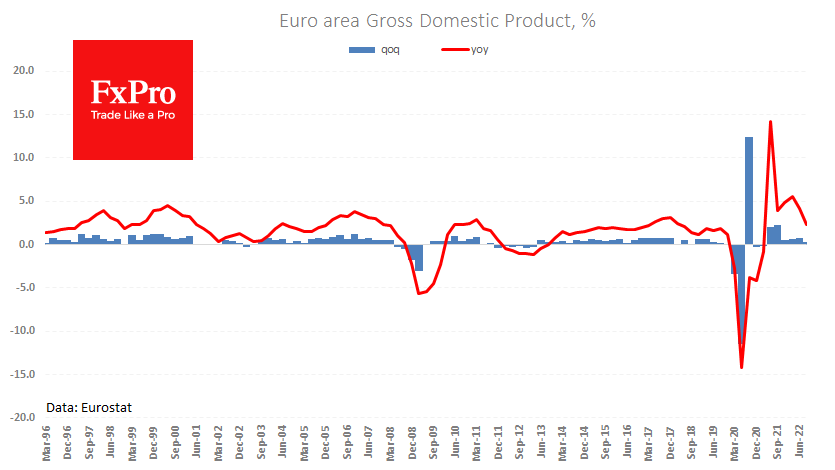

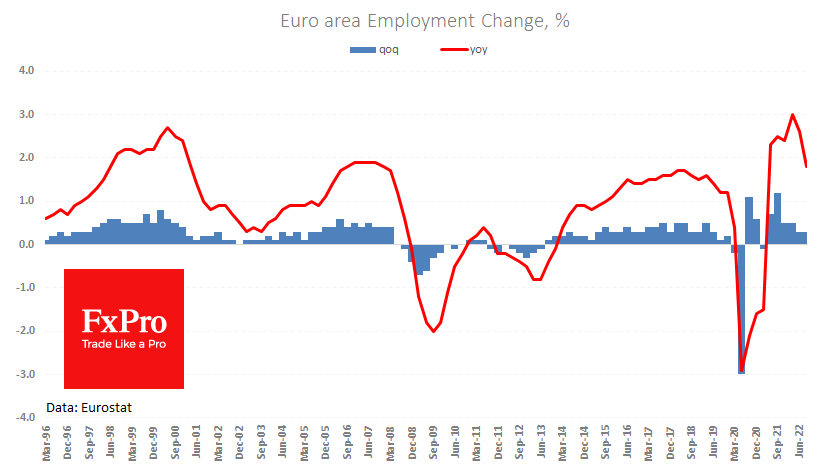

The final Q3 GDP reading for the Eurozone showed economic growth of 0.3% QoQ and 2.3% YoY (down from 0.2% and 2.1%, respectively). The employment growth estimate was also improved, recording job gains of 0.3% QoQ and 1.8% YoY.

Employment is supported by the recovery of the economy from the coronavirus restrictions. But the fragmentation of the global economy is also likely to be a factor, forcing European companies to increase local production, reducing dependence on global supply chains (energy from Russia, goods from China).

Interestingly, in contrast to the optimistic Q3 employment estimates, Reuters published a selection of large European companies that have announced layoffs or frozen hiring recently. The dynamics in employment may have already turned from growth to decline, but last quarter's robust data buys some more time for the ECB to actively hike interest rates, which is suitable for the single currency.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)