The crypto correction

Market picture

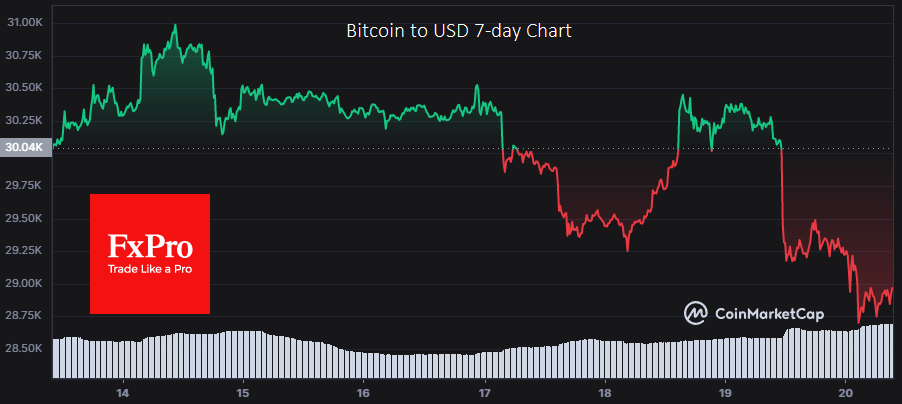

Bitcoin rolled back to $29,000 on Wednesday and fell to $28.6K at specific points on Thursday morning. The decline comes in strong impulses as high volumes are released into the market, triggering waves of stop orders. These impulses are followed by stabilisation periods when trading volume increases as if the big players are gradually absorbing the market as it declines. This could be long-term buying or just liquidity consolidation before a new wave of selling.

Bitcoin is correcting a 58% rally from the March lows to the April highs. If it manages to hold above $28,000, it would be a statement of very bullish market sentiment. A full correction to 61.8% of that rally would return the price to the 50-day moving average at $26.7K. And the market dynamics in this area are worth watching, as further declines will doubt the resumption of a sustained bull market in cryptocurrencies.

News Background

Trader Skew reported on Twitter that the dump was triggered by a market sell of 15k BTC on Binance.

Former US President Donald Trump has launched a second collection of non-transferable tokens (NFTs) - Trump Digital Trading Cards. Trump's trading cards are priced at $99. The tokens themselves are created on the Polygon blockchain. Trump said all the tokens were sold in hours, totalling $4.6 million.

Microsoft founder Bill Gates tried to explain the popularity of cryptocurrencies and NFT tokens. He says it is driven by the so-called "greater fool theory". According to this theory, one person in the world will always buy a commodity from another at a high price in the hope of reselling the asset at an even higher price.

According to the Wall Street Journal, NFT sales are down 92% from their peak. Tokens now sell for an average of $19,000. In September 2021, this figure was higher at $225,000.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)