The Crypto Market Bullish Pause

Market Picture

The cryptocurrency market paused growth early in the day on Monday after last week's resounding close, stabilising at $2.23 trillion (+8.8% in 7 days), which is near the previous peak. This means that further gains will be an important second signal for breaking the multi-month trend of lower local highs. Prior to this, we have seen a breaking of the sequence of lower local lows, which was the first signal of a trend change.

Bitcoin slipped to $64.4K on Monday morning, stabilising $1K lower at the time of writing. This tug-of-war near the 200-day simple moving average is in its fifth day. Monday saw the biggest move into territory above this curve. Still, traders should keep in mind last month's moves when a strong seller attack came after two days of consolidation above this line, also at roughly the same height.

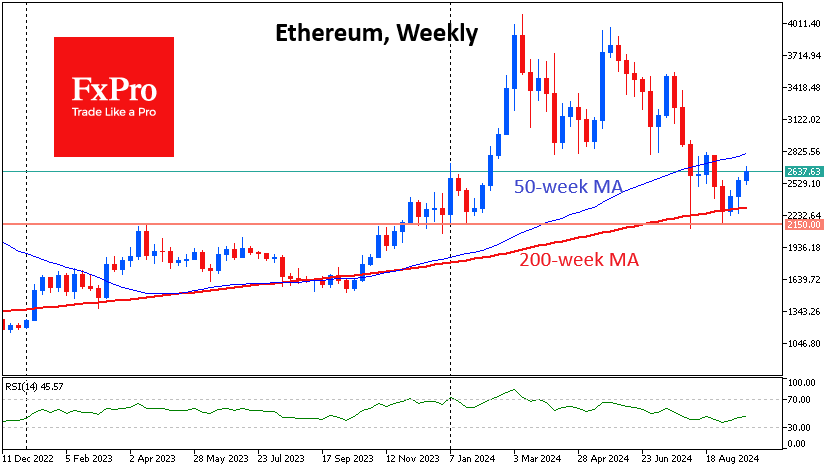

Ethereum has rebounded solidly from its 200-week moving average, which could attract additional long-term buyers. At current levels near $2650, the immediate upside target looks to be the $2800 area, where the 50-week average passes.

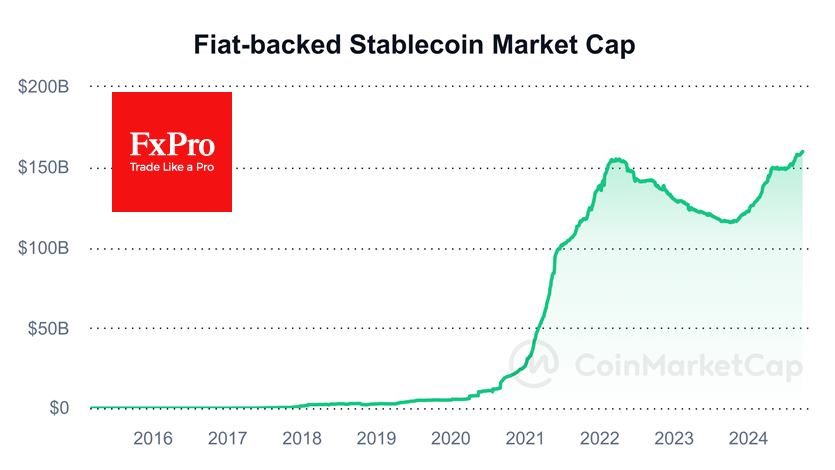

The generally positive mood of the crypto market is indicated by the growing capitalisation of the stablecoin market since August, approaching $160bn after three months of fluctuations around $150bn.

News Background

According to SoSoValue, inflows into spot bitcoin-ETFs in the US last week totalled $397m after $403.8m the week before, bringing the total to $17.69bn. Ethereum-ETFs saw net outflows for the sixth week in a row, totalling $26.3m after $12.9m, bringing the total to $607.5m since approval.

CryptoQuant pointed to the reduction of BTC supply at the disposal of speculators to the minimum of 2012. Such dynamics can be interpreted as a lack of ‘fresh demand’, which could make it difficult for bitcoin to break out of its current price range.

MicroStrategy reported purchasing an additional 7,420 BTC for $458.2 million (at a price of ~$61,750 per coin) after selling $1bn worth of bonds. The firm already holds 252,220 BTC on its balance sheet, purchased for $9.9bn at an average rate of ~$39,266 per coin.

The US SEC has given expedited approval for the listing and trading of options on BlackRock's bitcoin-ETF. Next, OCC and CFTC approval will be required before the official listing. Bloomberg speculated that options for other companies' products will also be approved soon.

Project founder Justin Sun said commissions on the TRON network have fallen by 50%, which will boost network activity and meme-coin trading.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)