The pound fears the Bank of England

Strong macroeconomic statistics, rising Treasury bond yields, and a drop in the rate cut probability in December to 62% did not help the dollar. Encouraged by the possibility of the Supreme Court abolishing tariffs, the US currency's competitors are finding footing. At the same time, the pullback in US stock indices allows parallels to be drawn with events 25 years ago.

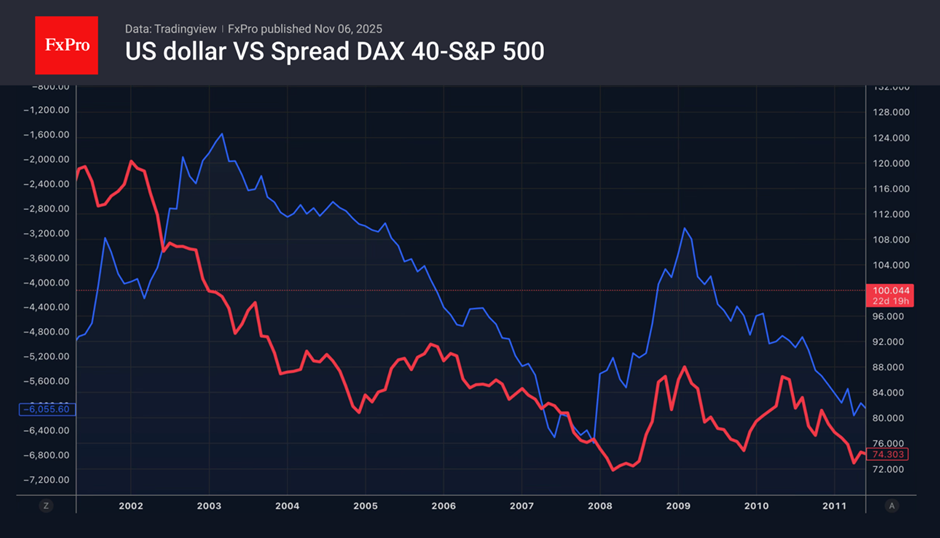

Following the collapse of the US stock market during the dot-com bubble, the USD declined over a period of eight years, from 2001 to 2008. Then it had lost about 40% of its value due to the diversification of investment portfolios in favour of foreign securities. The shares of modern technology giants are significantly overvalued. Companies are investing vast amounts of money in artificial intelligence. If the investments do not pay off, the bubble risks bursting. Capital outflows will deal a blow to the US currency.

The Supreme Court doubts that Congress will simply hand over to the White House its constitutional powers to increase budget revenues through taxes. And tariffs are taxes. In this scenario, America will have to return the money, and the budget gap and payment deficit will grow. This is already putting speculative pressure on the exchange rate.

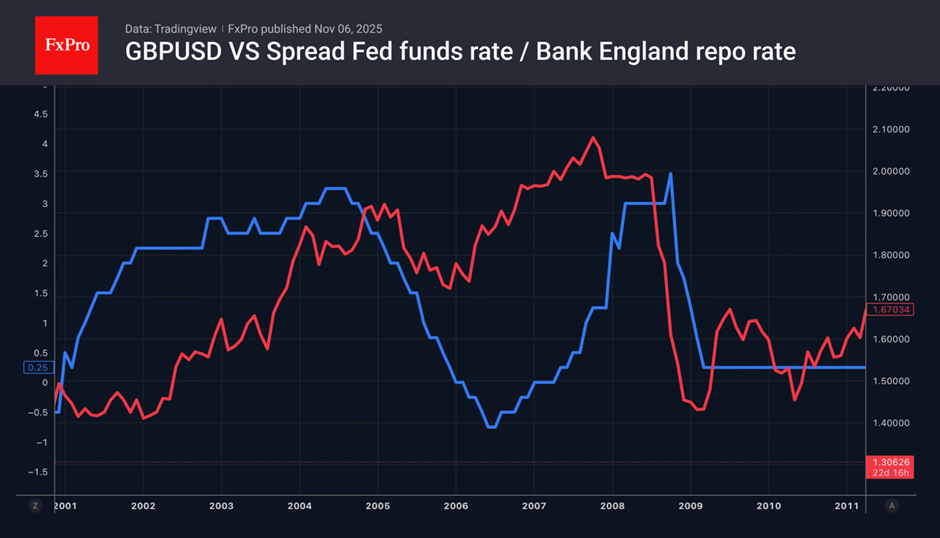

But the pound also has problems. It has fallen to a 7-month low due to fears of a ‘dovish’ surprise from the Bank of England at its meeting on November 6, which is causing the GBPUSD to fall. Some investors argue that the BoE will not take active measures until the Labour Party presents its draft budget. Others, on the contrary, believe that cooling inflation is sufficient to ease policy. The odds of a rate cut in November have risen to 1 in 3. A month ago, they were 1 in 10.

The USDJPY is attempting to consolidate near its February highs. The dovish rhetoric of the minutes of the Bank of Japan's latest meeting made a greater impression on traders than the government's verbal interventions and the acceleration of nominal wages in September to 1.9%. Macro statistics point to a rate hike, but the BoJ is in no hurry. Its caution is preventing the yen from rising.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)