US Dollar is Under Pressure Due to the Fed

By RoboForex Analytical Department

EUR/USD started the final week of April with stable moves near 1.0980. In the near term, the market's focus was on the upcoming US Federal Reserve System meeting, which will end on 3 May. Monetary policymakers are expected to further raise interest rates by 25 base points, although the focus will be on the future rate trajectory.

Investors believe the rate will remain unchanged until July and will drop by the end of the year. However, the state of the US economy might hinder this prediction. The latest statistics have shown that some sectors of the economy remain resilient, and inflation is declining.

The changes in the interest rate by the end of the year might turn out different from market expectations. At the same time, the market moods are quite vigorous.

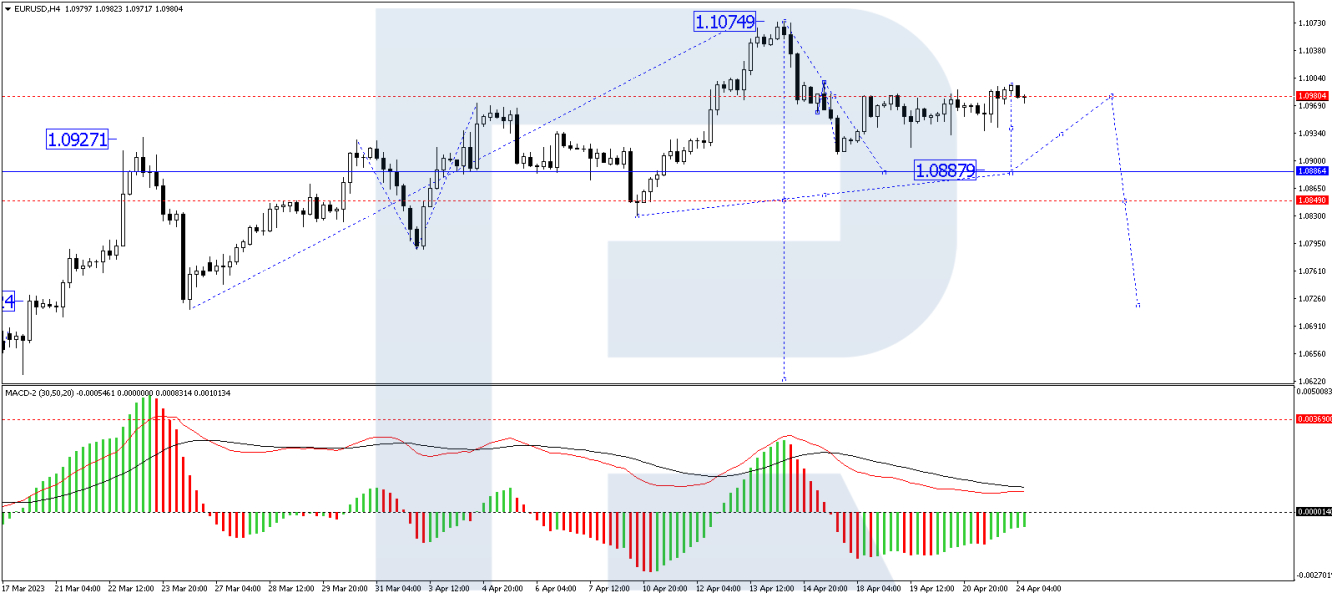

On the H4 chart, the EUR/USD pair has corrected to 1.0995. The market is now forming a consolidation range under this level. The price is expected to break the range downwards and form a descending wave structure to 1.0886. Technically, this scenario is confirmed by the MACD: its signal line is above zero, directed strictly downwards to renew the lows.

On the H1 chart, the EUR/USD pair continues developing a consolidation range around the level of 1.0980. An exit from the range downwards is expected, followed by a descending wave structure to 1.0940. The target is the first one. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 20, with growth to 50 expected, followed by a decline to the new lows of the indicator.

Disclaimer Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.