Euro pressured by German pessimism

Euro pressured by German pessimism

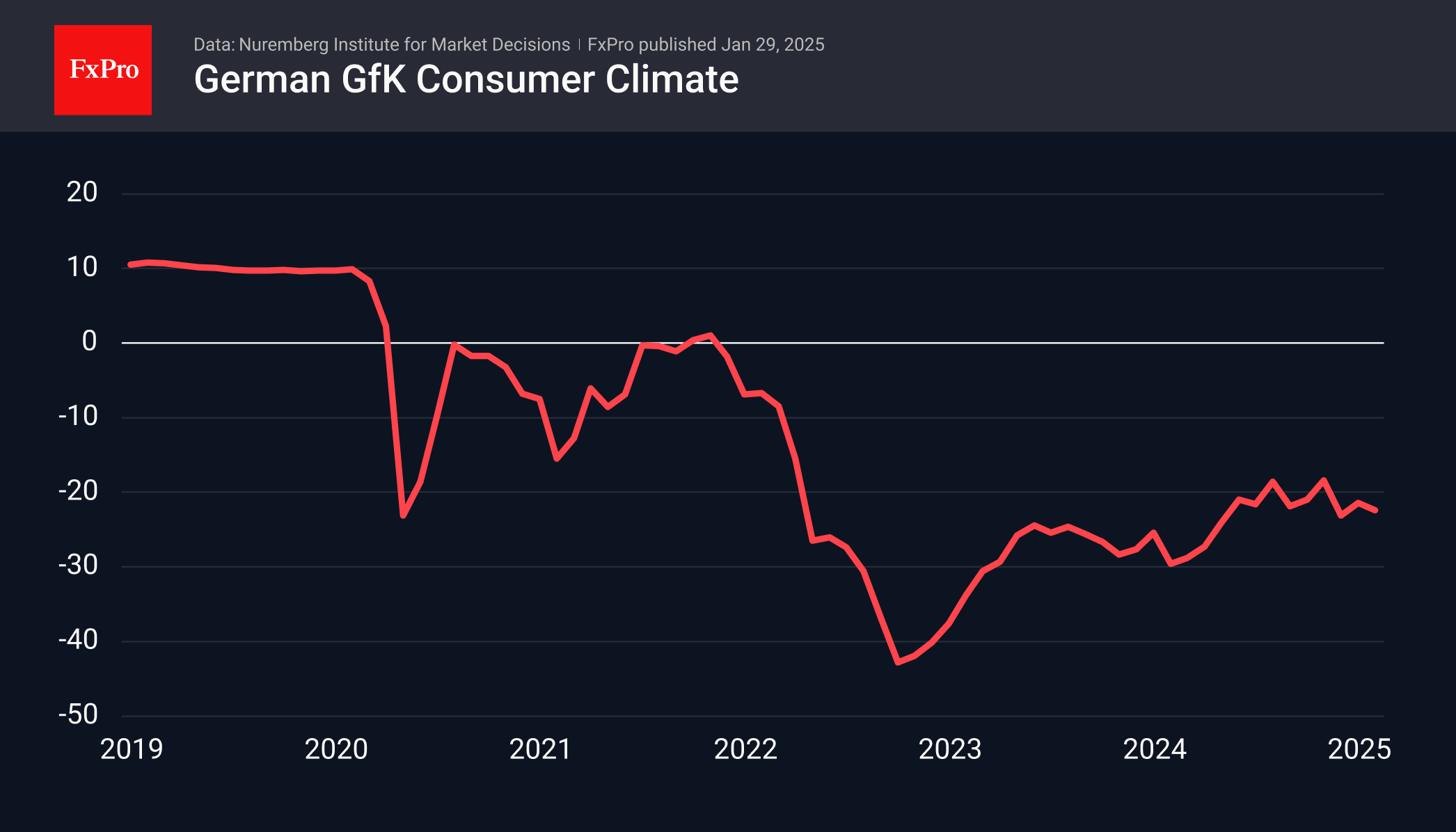

The German Consumer Climate Index declined in January, impacting the eurozone's largest economy and applying pressure on the single currency. The index fell by 1 point to -22.4 by February, having remained deeply negative since late 2021 without showing an upward trend since mid-last year. The report highlights a decrease in income expectations and purchase intentions, potentially linked to an increase in inflation.

Furthermore, the German Ministry of Economic Affairs adjusted its GDP growth forecast for 2025 from 1.1% to 0.3%, following contractions of 0.3% and 0.2% in 2023 and 2024, respectively. This economic situation underscores the need for continued monetary policy easing by the ECB despite indications of rising inflation.

Market participants are anticipating further rate cuts from the ECB, with expectations of a quarter-point reduction this coming Thursday and additional cuts later this year. In contrast, about two cuts are expected from the Fed and the Bank of England, with the possibility of fewer reductions in the US.

These market expectations suggest a potential decline in the euro against the dollar and pound, influenced by technical factors. The EURUSD rally from 13 to 27 January appears to be a technical rebound following the decline since October. The recovery lost momentum after surpassing the 50-day moving average and the 1.05 level. EURUSD is likely to consolidate below the 1.05 level, which could lead to declines below parity.

Regarding macroeconomic factors, especially consumer demand, the euro also seems weaker compared to the pound. The EURGBP pair declined for the fifth consecutive trading session, completing its technical rebound. Bearish sentiment resumed after reaching the 200-day moving average level. The euro has been depreciating against the pound since October 2023. The pair is approximately 1.75% above cyclical lows at 0.8250 but may retest these levels in the coming weeks. Consolidation below this mark could result in a fundamental reassessment of attitudes towards the euro, similar to the period in 2014-2015 when EURGBP fell below 0.7000.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)