Economic Calendar

|

Date

|

Time left

|

Event

|

Impact

|

Previous

|

Consensus

|

Actual

|

|||

|---|---|---|---|---|---|---|---|---|---|

|

Friday, Sep 19, 2025

|

|||||||||

|

Sep 19, 00:00

|

|

|

EUR | ECOFIN Meeting |

Low

|

||||

|

Sep 19, 00:00

|

|

|

EUR | Eurogroup Meeting |

Low

|

||||

|

Sep 19, 03:00

|

|

|

NZD | Credit Card Spending YoY (Aug) |

Low

|

1.6% |

1.7%

|

3.5% | |

|

Sep 19, 03:50

|

|

|

JPY | BoJ Interest Rate Decision |

High

|

0.5% |

0.5%

|

0.5% | |

|

Sep 19, 06:00

|

|

|

EUR | PPI YoY (Aug) |

Medium

|

-1.5% |

-1.7%

|

-2.2% | |

|

Sep 19, 06:00

|

|

|

EUR | PPI MoM (Aug) |

Low

|

-0.1% |

-0.1%

|

-0.5% | |

|

Sep 19, 06:00

|

|

|

GBP | Retail Sales ex Fuel YoY (Aug) |

High

|

1% |

1%

|

1.2% | |

|

Sep 19, 06:00

|

|

|

GBP | Retail Sales ex Fuel MoM (Aug) |

High

|

0.4% |

0.7%

|

0.8% | |

|

Sep 19, 06:00

|

|

|

GBP | Public Sector Net Borrowing Ex Banks (Aug) |

Low

|

-£2.82B |

-£12.75B

|

-£17.96B | |

|

Sep 19, 06:00

|

|

|

GBP | Retail Sales MoM (Aug) |

High

|

0.5% |

0.3%

|

0.5% | |

|

Sep 19, 06:00

|

|

|

GBP | Retail Sales YoY (Aug) |

High

|

0.8% |

0.6%

|

0.7% | |

|

Sep 19, 06:45

|

|

|

EUR | Business Climate Indicator (Sep) |

Low

|

96 |

95

|

96 | |

|

Sep 19, 06:45

|

|

|

EUR | Business Confidence (Sep) |

Medium

|

97 |

96

|

96 | |

|

Sep 19, 07:40

|

|

|

EUR | ECB Montagner Speech |

Low

|

||||

|

Sep 19, 08:00

|

|

|

EUR | Current Account (Jul) |

Low

|

€0.196B |

€0.2B

|

€0.938B | |

|

Sep 19, 08:00

|

|

|

EUR | Construction Output YoY (Jun) |

Low

|

5.5% |

3.4%

|

5.7% | |

|

Sep 19, 08:00

|

|

|

EUR | Construction Output YoY (Jul) |

Low

|

5.7% |

2.8%

|

5.2% | |

|

Sep 19, 08:30

|

|

|

EUR | Consumer Confidence (Sep) |

Low

|

-27 |

-23

|

-25 | |

|

Sep 19, 08:30

|

|

|

EUR | PPI YoY (Aug) |

Low

|

1.1% |

1%

|

0.9% | |

|

Sep 19, 09:30

|

|

|

EUR | ECB Tuominen Speech |

Low

|

||||

|

Sep 19, 10:00

|

|

|

EUR | PPI YoY (Aug) |

Low

|

-0.6% |

-0.8%

|

0.5% | |

|

Sep 19, 10:00

|

|

|

EUR | PPI MoM (Aug) |

Low

|

-0.1% |

-0.2%

|

1% | |

|

Sep 19, 11:30

|

|

|

CNY | FDI (YTD) YoY (Aug) |

Medium

|

-13.4% |

-13.2%

|

-12.7% | |

|

Sep 19, 12:30

|

|

|

CAD | Retail Sales MoM (Jul) |

High

|

1.6% |

-0.8%

|

-0.8% | |

|

Sep 19, 12:30

|

|

|

CAD | Retail Sales MoM (Aug) |

High

|

-0.8% |

0.4%

|

1% | |

|

Sep 19, 12:30

|

|

|

CAD | Retail Sales YoY (Jul) |

High

|

6.5% |

3.5%

|

4% | |

|

Sep 19, 12:30

|

|

|

CAD | Retail Sales Ex Autos MoM (Jul) |

High

|

2.2% |

-0.7%

|

-1.2% | |

|

Sep 19, 14:15

|

|

|

EUR | GDP Growth Rate YoY (Q2) |

Low

|

2.83% |

3.4%

|

4.58% | |

|

Sep 19, 17:00

|

8 min

|

|

USD | Baker Hughes Total Rigs Count (Sep/19) |

Low

|

539 | |||

|

Sep 19, 17:00

|

8 min

|

|

USD | Baker Hughes Oil Rig Count (Sep/19) |

Low

|

416 | |||

|

Sep 19, 18:30

|

1h 38min

|

|

USD | Fed Daly Speech |

Medium

|

||||

|

Saturday, Sep 20, 2025

|

|||||||||

|

Sep 20, 00:00

|

7h 8min

|

|

EUR | ECOFIN Meeting |

Low

|

||||

|

Monday, Sep 22, 2025

|

|||||||||

|

Sep 22, 00:00

|

2 days

|

|

USD | UN General Assembly |

Low

|

||||

|

Sep 22, 01:15

|

2 days

|

|

CNY | Loan Prime Rate 5Y (Sep) |

Medium

|

3.5% |

3.5%

|

||

|

Sep 22, 01:15

|

2 days

|

|

CNY | Loan Prime Rate 1Y |

Medium

|

3% |

3%

|

||

|

Sep 22, 02:00

|

2 days

|

|

USD | Inflation Rate MoM (Aug) |

Low

|

0.2% |

0.1%

|

||

|

Sep 22, 02:00

|

2 days

|

|

USD | Inflation Rate YoY (Aug) |

Low

|

0.3% |

0.5%

|

||

|

Sep 22, 04:30

|

2 days

|

|

EUR | Consumer Confidence (Sep) |

Medium

|

-32 |

-31

|

||

|

Sep 22, 05:00

|

2 days

|

|

EUR | PPI YoY (Aug) |

Low

|

-2.2% |

-3%

|

||

|

Sep 22, 05:00

|

2 days

|

|

EUR | PPI MoM (Aug) |

Low

|

-0.3% |

0.5%

|

||

|

Sep 22, 09:00

|

2 days

|

|

EUR | Consumer Confidence (Sep) |

Low

|

-2 |

-3

|

||

|

Sep 22, 09:00

|

2 days

|

|

EUR | Unemployment Rate (Jul) |

Low

|

4.3% |

4.4%

|

||

|

Sep 22, 09:30

|

2 days

|

|

EUR | 3-Month Bubill Auction |

Low

|

1.839% | |||

|

Sep 22, 09:30

|

2 days

|

|

EUR | 9-Month Bubill Auction |

Low

|

1.913% | |||

|

Sep 22, 09:45

|

2 days

|

|

EUR | EU Bond Auction |

Low

|

2.186% | |||

|

Sep 22, 09:45

|

2 days

|

|

EUR | 2035 EU-Bond Auction |

Low

|

3.199% | |||

|

Sep 22, 09:45

|

2 days

|

|

EUR | 2048 EU-Bond Auction |

Low

|

||||

|

Sep 22, 10:00

|

2 days

|

|

EUR | Unemployment Rate (Aug) |

Low

|

5% |

5%

|

||

|

Sep 22, 10:00

|

2 days

|

|

EUR | Unemployment Rate (Aug) |

Low

|

5.9% |

5.9%

|

||

|

Sep 22, 10:00

|

2 days

|

|

EUR | Wholesale Prices YoY (Aug) |

Low

|

-3.5% |

-3.2%

|

||

|

Sep 22, 10:00

|

2 days

|

|

EUR | Wholesale Prices MoM (Aug) |

Low

|

-0.5% |

-0.3%

|

||

|

Sep 22, 12:30

|

2 days

|

|

CAD | Raw Materials Prices YoY (Aug) |

Low

|

0.8% |

2.5%

|

||

|

Sep 22, 12:30

|

2 days

|

|

CAD | PPI YoY (Aug) |

Low

|

2.6% |

4.3%

|

||

|

Sep 22, 12:30

|

2 days

|

|

CAD | Raw Materials Prices MoM (Aug) |

Low

|

0.3% |

1.2%

|

||

|

Sep 22, 12:30

|

2 days

|

|

CAD | PPI MoM (Aug) |

Low

|

0.7% |

0.9%

|

||

|

Sep 22, 12:30

|

2 days

|

|

USD | Chicago Fed National Activity Index (Aug) |

Medium

|

-0.19 |

-0.17

|

||

|

Sep 22, 12:30

|

2 days

|

|

GBP | BoE Pill Speech |

Low

|

||||

|

Sep 22, 13:00

|

2 days

|

|

EUR | 12-Month BTF Auction |

Low

|

2.046% | |||

|

Sep 22, 13:00

|

2 days

|

|

EUR | 6-Month BTF Auction |

Low

|

2.027% | |||

|

Sep 22, 13:00

|

2 days

|

|

EUR | 3-Month BTF Auction |

Low

|

2.007% | |||

|

Sep 22, 13:45

|

2 days

|

|

USD | Fed Williams Speech |

Medium

|

||||

|

Sep 22, 14:00

|

2 days

|

|

EUR | Consumer Confidence (Sep) |

Medium

|

-15.5 |

-15.4

|

||

|

Sep 22, 14:00

|

2 days

|

|

USD | Fed Musalem Speech |

Medium

|

||||

|

Sep 22, 15:30

|

2 days

|

|

USD | 3-Month Bill Auction |

Low

|

3.905% | |||

|

Sep 22, 15:30

|

2 days

|

|

USD | 6-Month Bill Auction |

Low

|

3.715% | |||

|

Sep 22, 16:00

|

2 days

|

|

USD | Fed Hammack Speech |

Medium

|

||||

|

Sep 22, 16:00

|

2 days

|

|

USD | Fed Barkin Speech |

Medium

|

||||

|

Sep 22, 16:00

|

2 days

|

|

USD | Fed Miran Speech |

Medium

|

||||

|

Sep 22, 17:15

|

3 days

|

|

CAD | BoC Rogers Speech |

Low

|

||||

|

Sep 22, 18:00

|

3 days

|

|

GBP | BoE Gov Bailey Speech |

Medium

|

||||

|

Sep 22, 19:45

|

3 days

|

|

CAD | BoC Kozicki Speech |

Low

|

||||

|

Sep 22, 21:00

|

3 days

|

|

USD | Balance of Trade (Aug) |

Low

|

-$1078.53M |

-$1103M

|

||

|

Sep 22, 23:00

|

3 days

|

|

AUD | S&P Global Manufacturing PMI (Sep) |

High

|

53 |

52.7

|

||

|

Sep 22, 23:00

|

3 days

|

|

AUD | S&P Global Services PMI (Sep) |

High

|

55.8 |

51

|

||

|

Sep 22, 23:00

|

3 days

|

|

AUD | S&P Global Composite PMI (Sep) |

Low

|

55.5 |

50.4

|

||

|

Tuesday, Sep 23, 2025

|

|||||||||

|

Sep 23, 00:00

|

3 days

|

|

JPY | Autumnal Equinox Day |

None

|

||||

|

Sep 23, 00:00

|

3 days

|

|

USD | UN General Assembly |

Low

|

||||

|

Sep 23, 02:35

|

3 days

|

|

NZD | 1-Year Bill Auction |

Low

|

2.854% | |||

|

Sep 23, 02:35

|

3 days

|

|

NZD | 3-Month Bill Auction |

Low

|

2.966% | |||

|

Sep 23, 02:35

|

3 days

|

|

NZD | 6-Month Bill Auction |

Low

|

2.827% | |||

|

Sep 23, 04:30

|

3 days

|

|

EUR | GDP Growth Rate QoQ (Q2) |

Low

|

0.3% |

0.1%

|

||

|

Sep 23, 04:30

|

3 days

|

|

EUR | GDP Growth Rate YoY (Q2) |

Low

|

2.2% |

1.5%

|

||

|

Sep 23, 05:00

|

3 days

|

|

EUR | Unemployment Rate (Aug) |

Low

|

9.3% |

9.5%

|

||

|

Sep 23, 06:00

|

3 days

|

|

EUR | Industrial Production YoY (Aug) |

Low

|

1.8% |

2.2%

|

||

|

Sep 23, 06:00

|

3 days

|

|

EUR | Industrial Production MoM (Aug) |

Low

|

-1.8% |

1.5%

|

||

|

Sep 23, 07:00

|

3 days

|

|

CHF | Current Account (Q2) |

Medium

|

CHF19.4B |

CHF12.9B

|

||

|

Sep 23, 07:15

|

3 days

|

|

EUR | HCOB Composite PMI (Sep) |

Medium

|

49.8 |

49.9

|

||

|

Sep 23, 07:15

|

3 days

|

|

EUR | HCOB Services PMI (Sep) |

High

|

49.8 |

49.7

|

||

|

Sep 23, 07:15

|

3 days

|

|

EUR | HCOB Manufacturing PMI (Sep) |

High

|

50.4 |

50.2

|

||

|

Sep 23, 07:30

|

3 days

|

|

EUR | HCOB Composite PMI (Sep) |

Medium

|

50.5 |

50.5

|

||

|

Sep 23, 07:30

|

3 days

|

|

EUR | HCOB Services PMI (Sep) |

High

|

49.3 |

49.5

|

||

|

Sep 23, 07:30

|

3 days

|

|

EUR | HCOB Manufacturing PMI (Sep) |

High

|

49.8 |

50.1

|

||

|

Sep 23, 08:00

|

3 days

|

|

EUR | HCOB Services PMI (Sep) |

High

|

50.5 |

50.5

|

||

|

Sep 23, 08:00

|

3 days

|

|

EUR | HCOB Composite PMI (Sep) |

Medium

|

51 |

51.1

|

||

|

Sep 23, 08:00

|

3 days

|

|

EUR | HCOB Manufacturing PMI (Sep) |

High

|

50.7 |

50.8

|

||

|

Sep 23, 08:00

|

3 days

|

|

EUR | Balance of Trade (Jul) |

Medium

|

-€3.59B |

-€2.8B

|

||

|

Sep 23, 08:30

|

3 days

|

|

GBP | S&P Global Services PMI (Sep) |

High

|

54.2 |

53.6

|

||

|

Sep 23, 08:30

|

3 days

|

|

GBP | S&P Global Composite PMI (Sep) |

Low

|

53.5 |

52.9

|

||

|

Sep 23, 08:30

|

3 days

|

|

GBP | S&P Global Manufacturing PMI (Sep) |

High

|

47 |

47.2

|

||

|

Sep 23, 09:00

|

3 days

|

|

GBP | Treasury Gilt 2056 Auction |

Low

|

||||

|

Sep 23, 09:00

|

3 days

|

|

GBP | BoE Pill Speech |

Medium

|

||||

|

Sep 23, 09:30

|

3 days

|

|

EUR | 2-Year Schatz Auction |

Low

|

1.96% | |||

|

Sep 23, 10:00

|

3 days

|

|

EUR | Current Account (Q2) |

Low

|

€883M |

-€120M

|

||

|

Sep 23, 10:00

|

3 days

|

|

EUR | Current Account (Q2) |

Low

|

€28.2B |

€20.2B

|

||

|

Sep 23, 10:00

|

3 days

|

|

GBP | CBI Industrial Trends Orders (Sep) |

Medium

|

-33 |

-30

|

||

|

Sep 23, 11:00

|

3 days

|

|

EUR | Balance of Trade (Aug) |

Low

|

-€576.4M | |||

|

Sep 23, 12:30

|

3 days

|

|

CAD | New Housing Price Index MoM (Aug) |

Medium

|

-0.1% |

0%

|

||

|

Sep 23, 12:30

|

3 days

|

|

USD | Current Account (Q2) |

Medium

|

-$450.2B |

-$270B

|

||

|

Sep 23, 12:55

|

3 days

|

|

USD | Redbook YoY (Sep/20) |

Low

|

6.3% | |||

|

Sep 23, 13:00

|

3 days

|

|

USD | Fed Bowman Speech |

Medium

|

||||

|

Sep 23, 13:45

|

3 days

|

|

USD | S&P Global Services PMI (Sep) |

High

|

54.5 |

53

|

||

|

Sep 23, 13:45

|

3 days

|

|

USD | S&P Global Composite PMI (Sep) |

Medium

|

55.1 |

54.6

|

||

|

Sep 23, 13:45

|

3 days

|

|

USD | S&P Global Manufacturing PMI (Sep) |

High

|

53 |

51.6

|

||

|

Sep 23, 14:00

|

3 days

|

|

USD | Richmond Fed Manufacturing Index (Sep) |

Low

|

-7 |

-5

|

||

|

Sep 23, 14:00

|

3 days

|

|

USD | Richmond Fed Manufacturing Shipments Index (Sep) |

Low

|

-5 |

-9

|

||

|

Sep 23, 14:00

|

3 days

|

|

USD | Richmond Fed Services Revenues Index (Sep) |

Low

|

4 |

3

|

||

|

Sep 23, 14:00

|

3 days

|

|

USD | Fed Bostic Speech |

Medium

|

||||

|

Sep 23, 14:20

|

3 days

|

|

EUR | ECB Cipollone Speech |

Low

|

||||

|

Sep 23, 16:35

|

3 days

|

|

USD | Fed Chair Powell Speech |

High

|

||||

|

Sep 23, 17:00

|

4 days

|

|

USD | Money Supply (Aug) |

Low

|

$22.12T | |||

|

Sep 23, 17:00

|

4 days

|

|

USD | 2-Year Note Auction |

Low

|

3.641% | |||

|

Sep 23, 18:30

|

4 days

|

|

CAD | BoC Macklem Speech |

Low

|

||||

|

Sep 23, 20:30

|

4 days

|

|

USD | API Crude Oil Stock Change (Sep/19) |

Medium

|

-3.42M | |||

|

Wednesday, Sep 24, 2025

|

|||||||||

|

Sep 24, 00:00

|

4 days

|

|

USD | UN General Assembly |

Low

|

||||

|

Sep 24, 00:30

|

4 days

|

|

JPY | S&P Global Composite PMI (Sep) |

Low

|

52 |

52.2

|

||

|

Sep 24, 00:30

|

4 days

|

|

JPY | S&P Global Services PMI (Sep) |

Medium

|

53.1 |

53.4

|

||

|

Sep 24, 00:30

|

4 days

|

|

JPY | S&P Global Manufacturing PMI (Sep) |

Medium

|

49.7 |

50.2

|

||

|

Sep 24, 01:30

|

4 days

|

|

AUD | Monthly CPI Indicator (Aug) |

High

|

2.8% |

2.8%

|

||

|

Sep 24, 01:30

|

4 days

|

|

AUD | RBA Payments System Board Annual Report 2025 |

Low

|

||||

|

Sep 24, 03:35

|

4 days

|

|

JPY | BoJ JGB Purchases |

Low

|

||||

|

Sep 24, 05:00

|

4 days

|

|

EUR | PPI YoY (Aug) |

Low

|

-1.5% |

-1.3%

|

||

|

Sep 24, 05:00

|

4 days

|

|

EUR | Import Prices YoY (Aug) |

Low

|

-2.6% |

-2%

|

||

|

Sep 24, 05:00

|

4 days

|

|

EUR | Export Prices YoY (Aug) |

Low

|

-2.7% |

-2.4%

|

||

|

Sep 24, 07:00

|

4 days

|

|

EUR | ECB Non-Monetary Policy Meeting |

Low

|

||||

|

Sep 24, 07:00

|

4 days

|

|

EUR | PPI YoY (Aug) |

Low

|

0.3% |

0.1%

|

||

|

Sep 24, 07:15

|

4 days

|

|

EUR | ECB Machado Speech |

Low

|

||||

|

Sep 24, 08:00

|

4 days

|

|

EUR | Ifo Business Climate (Sep) |

High

|

89 |

89.5

|

||

|

Sep 24, 08:00

|

4 days

|

|

EUR | Ifo Current Conditions (Sep) |

Low

|

86.4 |

86.6

|

||

|

Sep 24, 08:00

|

4 days

|

|

EUR | Ifo Expectations (Sep) |

Low

|

91.6 |

92

|

||

|

Sep 24, 08:00

|

4 days

|

|

CHF | Economic Sentiment Index (Sep) |

Low

|

-53.8 |

-40

|

||

|

Sep 24, 08:30

|

4 days

|

|

EUR | Business Confidence (Sep) |

Low

|

-6 |

-6

|

||

|

Sep 24, 09:00

|

4 days

|

|

GBP | Treasury Gilt 2030 Auction |

Low

|

4.022% | |||

|

Sep 24, 09:10

|

4 days

|

|

EUR | 2-Year BTP Short Term Auction |

Low

|

2.2% | |||

|

Sep 24, 09:10

|

4 days

|

|

EUR | BTP€i Auction |

Low

|

||||

|

Sep 24, 09:30

|

4 days

|

|

EUR | 7-Year Bund Auction |

Low

|

2.46% | |||

|

Sep 24, 11:00

|

4 days

|

|

USD | MBA Purchase Index (Sep/19) |

Low

|

174 | |||

|

Sep 24, 11:00

|

4 days

|

|

USD | MBA Mortgage Applications (Sep/19) |

Low

|

29.7% | |||

|

Sep 24, 11:00

|

4 days

|

|

USD | MBA Mortgage Market Index (Sep/19) |

Low

|

386.1 | |||

|

Sep 24, 11:00

|

4 days

|

|

USD | MBA 30-Year Mortgage Rate (Sep/19) |

Medium

|

6.39% | |||

|

Sep 24, 11:00

|

4 days

|

|

USD | MBA Mortgage Refinance Index (Sep/19) |

Low

|

1596.7 | |||

|

Sep 24, 12:00

|

4 days

|

|

USD | Building Permits MoM (Aug) |

Low

|

-2.2% |

-3.7%

|

||

|

Sep 24, 12:00

|

4 days

|

|

USD | Building Permits (Aug) |

Low

|

1.362M |

1.312M

|

||

|

Sep 24, 13:00

|

4 days

|

|

EUR | Business Confidence (Sep) |

Low

|

-8.9 |

-8

|

||

|

Sep 24, 14:00

|

4 days

|

|

USD | New Home Sales MoM (Aug) |

High

|

-0.6% |

-1.8%

|

||

|

Sep 24, 14:00

|

4 days

|

|

USD | New Home Sales (Aug) |

High

|

0.652M |

0.65M

|

||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Gasoline Stocks Change (Sep/19) |

Medium

|

-2.347M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Crude Oil Imports Change (Sep/19) |

Low

|

-3.111M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Distillate Fuel Production Change (Sep/19) |

Low

|

-0.274M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Gasoline Production Change (Sep/19) |

Low

|

-0.18M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Crude Oil Stocks Change (Sep/19) |

Medium

|

-9.285M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Heating Oil Stocks Change (Sep/19) |

Low

|

0.67M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Distillate Stocks Change (Sep/19) |

Low

|

4.046M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Cushing Crude Oil Stocks Change (Sep/19) |

Low

|

-0.296M | |||

|

Sep 24, 14:30

|

4 days

|

|

USD | EIA Refinery Crude Runs Change (Sep/19) |

Low

|

-0.394M | |||

|

Sep 24, 15:30

|

4 days

|

|

USD | 17-Week Bill Auction |

Low

|

3.815% | |||

|

Sep 24, 15:30

|

4 days

|

|

USD | 2-Year FRN Auction |

Low

|

0.195% | |||

|

Sep 24, 16:00

|

4 days

|

|

CAD | 10-Year Bond Auction |

Low

|

3.506% | |||

|

Sep 24, 16:30

|

4 days

|

|

GBP | BoE Greene Speech |

Medium

|

||||

|

Sep 24, 17:00

|

5 days

|

|

USD | 5-Year Note Auction |

Low

|

3.724% | |||

|

Sep 24, 20:10

|

5 days

|

|

USD | Fed Daly Speech |

Medium

|

||||

|

Sep 24, 23:01

|

5 days

|

|

GBP | Car Production YoY (Aug) |

Low

|

5.6% |

5%

|

||

|

Sep 24, 23:50

|

5 days

|

|

JPY | BoJ Monetary Policy Meeting Minutes |

Medium

|

||||

|

Thursday, Sep 25, 2025

|

|||||||||

|

Sep 25, 00:00

|

5 days

|

|

USD | UN General Assembly |

Low

|

||||

|

Sep 25, 03:35

|

5 days

|

|

JPY | 40-Year JGB Auction |

Low

|

3.375% | |||

|

Sep 25, 04:00

|

5 days

|

|

EUR | New Car Registrations YoY (Aug) |

Medium

|

7.4% |

9.1%

|

||

|

Sep 25, 06:00

|

5 days

|

|

EUR | GfK Consumer Confidence (Oct) |

High

|

-23.6 |

-23

|

||

|

Sep 25, 06:45

|

5 days

|

|

EUR | Consumer Confidence (Sep) |

Medium

|

87 |

86

|

||

|

Sep 25, 07:30

|

5 days

|

|

CHF | SNB Interest Rate Decision |

High

|

0% |

0%

|

||

|

Sep 25, 08:00

|

5 days

|

|

EUR | 4-Month ATB Auction |

Low

|

1.94% | |||

|

Sep 25, 08:00

|

5 days

|

|

EUR | 6-Month Green ATB Auction |

Low

|

2.17% | |||

|

Sep 25, 08:00

|

5 days

|

|

EUR | Loans to Households YoY (Aug) |

Low

|

2.4% |

2.3%

|

||

|

Sep 25, 08:00

|

5 days

|

|

EUR | M3 Money Supply YoY (Aug) |

Low

|

3.4% |

3.3%

|

||

|

Sep 25, 08:00

|

5 days

|

|

EUR | Loans to Companies YoY (Aug) |

Low

|

2.8% |

2.9%

|

||

|

Sep 25, 08:30

|

5 days

|

|

EUR | Tourist Arrivals YoY (Aug) |

Low

|

2.5% |

7%

|

||

|

Sep 25, 09:00

|

5 days

|

|

GBP | Treasury Gilt 2034 Auction |

Low

|

4.553% | |||

|

Sep 25, 09:10

|

5 days

|

|

EUR | 6-Month BOT Auction |

Low

|

2.012% | |||

|

Sep 25, 10:00

|

5 days

|

|

EUR | Total Credit YoY (Aug) |

Low

|

7.2% |

7%

|

||

|

Sep 25, 10:00

|

5 days

|

|

EUR | Balance of Trade (Jul) |

Low

|

-€0.63B |

-€0.6B

|

||

|

Sep 25, 10:00

|

5 days

|

|

GBP | CBI Distributive Trades (Sep) |

Medium

|

-32 |

-26

|

||

|

Sep 25, 10:00

|

5 days

|

|

GBP | Treasury Stock 2038 Auction |

Low

|

3.981% | |||

|

Sep 25, 12:20

|

5 days

|

|

USD | Fed Goolsbee Speech |

Medium

|

||||

|

Sep 25, 12:30

|

5 days

|

|

USD | Continuing Jobless Claims (Sep/13) |

High

|

1920K |

1925K

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Initial Jobless Claims (Sep/20) |

High

|

231K |

240K

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Jobless Claims 4-week Average (Sep/20) |

High

|

240K |

242.75K

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | PCE Prices QoQ (Q2) |

Low

|

3.7% |

2%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Core PCE Prices QoQ (Q2) |

Low

|

3.5% |

2.5%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | GDP Sales QoQ (Q2) |

Low

|

-3.1% |

6.8%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Goods Trade Balance (Aug) |

High

|

-$103.6B |

-$95.2B

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | GDP Growth Rate QoQ (Q2) |

High

|

-0.5% |

3.3%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | GDP Price Index QoQ (Q2) |

Medium

|

3.8% |

2%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Durable Goods Orders ex Defense MoM (Aug) |

High

|

-2.5% |

-0.4%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Real Consumer Spending QoQ (Q2) |

Low

|

0.5% |

1.6%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Non Defense Goods Orders Ex Air (Aug) |

Low

|

1.1% |

0.2%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Corporate Profits QoQ (Q2) |

Low

|

-3.3% |

2%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Durable Goods Orders Ex Transp MoM (Aug) |

High

|

1.1% |

-0.1%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Durable Goods Orders MoM (Aug) |

High

|

-2.8% |

-0.4%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Retail Inventories Ex Autos MoM (Aug) |

Medium

|

0.1% |

-0.2%

|

||

|

Sep 25, 12:30

|

5 days

|

|

USD | Wholesale Inventories MoM (Aug) |

Medium

|

0.1% |

0.1%

|

||

|

Sep 25, 12:30

|

5 days

|

|

CAD | Average Weekly Earnings YoY (Jul) |

Low

|

3.7% |

3.6%

|

||

|

Sep 25, 13:00

|

5 days

|

|

USD | Fed Williams Speech |

Medium

|

||||

|

Sep 25, 14:00

|

5 days

|

|

USD | Existing Home Sales (Aug) |

High

|

4.01M |

3.98M

|

||

|

Sep 25, 14:00

|

5 days

|

|

USD | Existing Home Sales MoM (Aug) |

High

|

2% |

-0.2%

|

||

|

Sep 25, 14:00

|

5 days

|

|

USD | Fed Bowman Speech |

Medium

|

||||

|

Sep 25, 14:30

|

5 days

|

|

USD | EIA Natural Gas Stocks Change (Sep/19) |

Low

|

90B | |||

|

Sep 25, 15:00

|

5 days

|

|

USD | Kansas Fed Composite Index (Sep) |

Low

|

1 |

-2

|

||

|

Sep 25, 15:00

|

5 days

|

|

USD | Kansas Fed Manufacturing Index (Sep) |

Low

|

0 |

-5

|

||

|

Sep 25, 15:30

|

5 days

|

|

USD | 4-Week Bill Auction |

Low

|

4.04% | |||

|

Sep 25, 15:30

|

5 days

|

|

USD | 8-Week Bill Auction |

Low

|

3.965% | |||

|

Sep 25, 16:00

|

5 days

|

|

CAD | 30-Year Bond Auction |

Low

|

3.911% | |||

|

Sep 25, 16:00

|

5 days

|

|

USD | 30-Year Mortgage Rate (Sep/25) |

Low

|

6.26% | |||

|

Sep 25, 16:00

|

5 days

|

|

USD | 15-Year Mortgage Rate (Sep/25) |

Low

|

5.41% | |||

|

Sep 25, 17:00

|

6 days

|

|

USD | 7-Year Note Auction |

Low

|

3.925% | |||

|

Sep 25, 17:00

|

6 days

|

|

USD | Fed Barr Speech |

Medium

|

||||

|

Sep 25, 19:30

|

6 days

|

|

USD | Fed Daly Speech |

Medium

|

||||

|

Sep 25, 20:30

|

6 days

|

|

USD | Fed Balance Sheet (Sep/24) |

Low

|

$6.61T | |||

|

Sep 25, 22:00

|

6 days

|

|

NZD | ANZ Roy Morgan Consumer Confidence (Sep) |

Low

|

92 |

97

|

||

|

Sep 25, 23:01

|

6 days

|

|

EUR | Consumer Confidence (Sep) |

Low

|

61.1 |

61.5

|

||

|

Sep 25, 23:30

|

6 days

|

|

JPY | Tokyo CPI Ex Food and Energy YoY (Sep) |

Low

|

3% |

3.3%

|

||

|

Sep 25, 23:30

|

6 days

|

|

JPY | Tokyo Core CPI YoY (Sep) |

Low

|

2.5% |

2.8%

|

||

|

Sep 25, 23:30

|

6 days

|

|

JPY | Tokyo CPI YoY (Sep) |

Low

|

2.6% |

2.9%

|

||

|

Sep 25, 23:50

|

6 days

|

|

JPY | Foreign Bond Investment (Sep/20) |

Low

|

¥1478.5B | |||

|

Sep 25, 23:50

|

6 days

|

|

JPY | Stock Investment by Foreigners (Sep/20) |

Low

|

-¥2034B | |||

|

Friday, Sep 26, 2025

|

|||||||||

|

Sep 26, 00:00

|

6 days

|

|

USD | UN General Assembly |

Low

|

||||

|

Sep 26, 03:35

|

6 days

|

|

JPY | 3-Month Bill Auction |

Low

|

0.457% | |||

|

Sep 26, 05:30

|

6 days

|

|

JPY | BoJ Noguchi Speech |

Medium

|

||||

|

Sep 26, 06:00

|

6 days

|

|

EUR | Retail Sales YoY (Aug) |

Low

|

5.1% |

4.8%

|

||

|

Sep 26, 07:00

|

6 days

|

|

EUR | GDP Growth Rate YoY (Q2) |

Low

|

2.8% |

2.8%

|

||

|

Sep 26, 07:00

|

6 days

|

|

EUR | GDP Growth Rate QoQ (Q2) |

Low

|

0.6% |

0.7%

|

||

|

Sep 26, 08:00

|

6 days

|

|

EUR | UniCredit Bank Manufacturing PMI (Sep) |

High

|

49.1 |

49.5

|

||

|

Sep 26, 08:00

|

6 days

|

|

EUR | Business Confidence (Sep) |

Medium

|

87.4 |

87

|

||

|

Sep 26, 08:00

|

6 days

|

|

EUR | Consumer Confidence (Sep) |

Medium

|

96.2 |

96

|

||

|

Sep 26, 09:00

|

6 days

|

|

EUR | Industrial Production YoY (Jul) |

Low

|

0.8% |

0.1%

|

||

|

Sep 26, 09:00

|

6 days

|

|

EUR | ECB Consumer Inflation Expectations (Aug) |

Low

|

2.6% |

2.6%

|

||

|

Sep 26, 09:10

|

6 days

|

|

EUR | BTP Auction |

Low

|

||||

|

Sep 26, 09:30

|

6 days

|

|

EUR | ECB President Lagarde Speech |

Medium

|

||||

|

Sep 26, 10:00

|

6 days

|

|

EUR | Unemployment Benefit Claims (Aug) |

Medium

|

52.9K |

25.1K

|

||

|

Sep 26, 10:00

|

6 days

|

|

EUR | Jobseekers Total (Aug) |

Low

|

3033.5K |

3058.6K

|

||

|

Sep 26, 12:00

|

6 days

|

|

USD | Fed Hammack Speech |

Medium

|

||||

|

Sep 26, 12:30

|

6 days

|

|

CAD | GDP MoM (Aug) |

Medium

|

0.2

|

|||

|

Sep 26, 12:30

|

6 days

|

|

CAD | GDP MoM (Jul) |

Medium

|

-0.1% |

0.1%

|

||

|

Sep 26, 12:30

|

6 days

|

|

CAD | Wholesale Sales MoM (Aug) |

Low

|

1.2% |

0.7%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | Personal Income MoM (Aug) |

High

|

0.4% |

0.3%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | Core PCE Price Index MoM (Aug) |

High

|

0.3% |

0.2%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | PCE Price Index MoM (Aug) |

Medium

|

0.2% |

0.3%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | Core PCE Price Index YoY (Aug) |

High

|

2.9% |

3%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | PCE Price Index YoY (Aug) |

Medium

|

2.6% |

2.8%

|

||

|

Sep 26, 12:30

|

6 days

|

|

USD | Personal Spending MoM (Aug) |

High

|

0.5% |

0.5%

|

||

|

Sep 26, 13:00

|

6 days

|

|

USD | Fed Barkin Speech |

Medium

|

||||

|

Sep 26, 14:00

|

6 days

|

|

USD | Michigan Inflation Expectations (Sep) |

Low

|

4.8% |

4.8%

|

||

|

Sep 26, 14:00

|

6 days

|

|

USD | Michigan Current Conditions (Sep) |

Low

|

61.7 |

61.2

|

||

|

Sep 26, 14:00

|

6 days

|

|

USD | Michigan 5 Year Inflation Expectations (Sep) |

Low

|

3.5% |

3.9%

|

||

|

Sep 26, 14:00

|

6 days

|

|

USD | Michigan Consumer Expectations (Sep) |

Low

|

55.9 |

51.8

|

||

|

Sep 26, 14:00

|

6 days

|

|

USD | Michigan Consumer Sentiment (Sep) |

High

|

58.2 |

55.9

|

||

|

Sep 26, 15:00

|

6 days

|

|

CAD | Budget Balance (Jul) |

Low

|

C$3.63B |

C$0.5B

|

||

|

Sep 26, 17:00

|

7 days

|

|

USD | Baker Hughes Oil Rig Count (Sep/26) |

Low

|

||||

|

Sep 26, 17:00

|

7 days

|

|

USD | Baker Hughes Total Rigs Count (Sep/26) |

Low

|

||||

|

Sep 26, 17:00

|

7 days

|

|

USD | Fed Bowman Speech |

Medium

|

||||

|

Sep 26, 17:30

|

7 days

|

|

USD | Fed Musalem Speech |

Medium

|

||||

|

Sep 26, 22:00

|

7 days

|

|

USD | Fed Bostic Speech |

Medium

|

||||

What is an Economic Calendar?

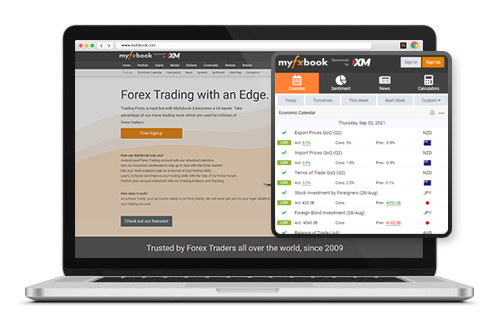

The Forex market is highly responsive to economic news and data. An Economic Calendar is a tool for traders that tracks and displays upcoming economic events, including releases of economic indicators, reports, and other financial data in real-time. These events range from interest rate decisions and employment reports to GDP releases and inflation figures. Traders use it to anticipate market movements, assess potential risks, and make strategic decisions based on upcoming economic data.

Our fx economic calendar is designed to empower your trading decisions. Access the current and future economic events calendar staying ahead of the markets with our real-time updates. Easily go from the daily FX calendar to planning for the next week economic calendar.

Whether youre interested in the world economic calendar or tracking a specific regions calendar like the US, UK, Australia, Canada economic calendar, our platform ensures you are well-informed.

How to Read and Use the Forex Economic Calendar?

Understanding and effectively utilizing a Forex Economic Calendar is key to making informed trading decisions. We provide you with the best economic calendar, which is designed with user-friendly features to optimize your trading experience:

Real-Time Updates: Our economic calendar provides real-time updates on scheduled economic events, informing you about potential market movers.

Custom Notifications: Set up personalized notifications for specific economic events. Receive email alerts at predetermined intervals, ensuring you never miss a critical update.

Risk Management: The trading economic calendar is an invaluable tool for risk management. Each event is categorized by impact level - from no impact to high impact. This classification facilitates the anticipation and reduction of risks linked to fluctuations in the market.

Event Details: Click on any event in the economic data calendar to access detailed information. This includes event explanations, data sources, and historical values where available, offering a comprehensive view of each event.

Currency Filtering: Tailor the calendar to your trading preferences by filtering events based on currency. This lets you focus on the events most relevant to your trading pairs.

Past Event Analysis: Use the economic calendar to explore past economic events and their effects on the Forex market. Understanding historical trends can enhance your ability to anticipate market movements.

Visit Our Education Center and learn more about Economic Calendars.

Use our interactive holiday calendar to track upcoming global holidays that may affect Forex trading, and to help you stay informed and make better trading decisions throughout the year.

Stay up to date!

Add Calendar to your browser

Add To Chrome

Add To Chrome