Recent Systems

| Name | Gain | Monthly | ||

|---|---|---|---|---|

|

|

THEBADDESTEA

kyle2024

|

+695646.90% | +695646.90% | |

|

|

Well Forex Conta Publica Demo

wellediel

|

+27.85% | +27.85% | |

|

|

EA BRPR-2- EURUSD Auto Trading by DPNTFX

createwealth

|

+16.85% | +14.02% | |

|

|

The Boss - Copy Trading

Forex_Trader10

|

+256.00% | +256.00% | |

|

|

Robo de Bonus Trade IA 2

tradeia

|

+31.61% | +18.51% | |

|

|

Roboforex-Demo-H2O EA

CANSIVG

|

+54.58% | +54.58% | |

|

|

KnightForex

Bytradingfx

|

+15.98% | +7.52% | |

|

|

FX Path Fund

linhthatsat

|

+14588.32% | +13.15% | |

|

|

Gold Path Fund

linhthatsat

|

+4110.61% | +12.80% | |

|

|

DuoForex

Bytradingfx

|

+69.37% | +7.17% |

Economic Calendar

|

Event

|

Prev.

|

Cons.

|

Act.

|

|||

|---|---|---|---|---|---|---|

|

32m

Low

|

USD | 5.24% | ||||

|

1h 2m

Low

|

MWK | 26% |

26%

|

|||

|

3h 2m

High

|

USD | 5.5% |

5.5%

|

|||

|

3h 2m

Med

|

BRL | $7.483B |

$7B

|

|||

|

3h 32m

High

|

USD | |||||

|

4h 2m

Low

|

MXN | -MXN399.7B |

-MXN78.7B

|

|||

|

4h 2m

Low

|

ARS | ARS7726B | ||||

|

7h 47m

Low

|

NZD | 14.9% |

-6.3%

|

|||

|

8h 2m

Low

|

KRW | 0.1% |

0.2%

|

|||

|

8h 2m

Med

|

KRW | 3.1% |

3%

|

|||

|

8h 52m

Low

|

JPY | -¥492.4B | ||||

|

8h 52m

Low

|

JPY | ¥648.1B | ||||

|

8h 52m

Med

|

JPY | |||||

|

9h 2m

None

|

BAM |

Labor Day

|

||||

|

9h 2m

None

|

CNY |

May Day

|

||||

|

9h 2m

None

|

EUR |

Labor day

|

||||

|

9h 2m

None

|

RSD |

Labor Day

|

||||

|

9h 2m

None

|

EUR |

Labor Day

|

||||

|

9h 32m

Low

|

IDR | 54.2 |

54.1

|

|||

|

9h 32m

Low

|

MYR | 48.4 |

48.7

|

|||

|

9h 32m

Low

|

MMK | 48.3 |

48.6

|

|||

|

9h 32m

Low

|

PHP | 50.9 |

50.7

|

|||

|

9h 32m

Med

|

KRW | 49.8 |

49.9

|

|||

|

9h 32m

Low

|

TWD | 49.3 |

49.6

|

|||

|

9h 32m

Low

|

THB | 49.1 |

49.3

|

|||

|

9h 32m

Low

|

VND | 49.9 |

50

|

|||

|

10h 2m

Low

|

PHP | -1.2% |

1.2%

|

|||

|

10h 32m

Low

|

AUD | -2.2% | ||||

|

10h 32m

Low

|

AUD | 4.8% | ||||

|

10h 32m

High

|

AUD | A$7.28B |

A$7.3B

|

|||

|

10h 32m

Med

|

AUD | -1.9% |

3%

|

|||

|

10h 32m

Low

|

AUD | 10.7% |

-6.3%

|

|||

|

12h 37m

Low

|

JPY | 0.009% | ||||

|

13h 2m

Low

|

IDR | 0.52% |

0.21%

|

|||

|

13h 2m

Low

|

IDR | 1.77% |

1.76%

|

|||

|

13h 2m

Med

|

IDR | 3.05% |

3.06%

|

|||

|

13h 47m

Med

|

CAD | |||||

|

14h 2m

High

|

JPY | 39.5 |

39.7

|

|||

|

14h 2m

Low

|

INR | 59.1 |

59.5

|

|||

|

14h 2m

Low

|

IDR | 38.24% |

20%

|

|||

|

15h 2m

Low

|

KZT | 51.6 |

51.7

|

|||

|

15h 2m

Med

|

RUB | 55.7 |

55.3

|

|||

|

15h 32m

High

|

CHF | -0.1% |

0.8%

|

|||

|

15h 32m

High

|

CHF | -0.2% |

0.2%

|

|||

|

15h 32m

Low

|

HUF | €583M |

€1652M

|

|||

|

15h 32m

Low

|

SEK | 50 |

50.8

|

|||

|

15h 32m

Med

|

CHF | 1% |

1.1%

|

|||

|

15h 32m

Low

|

CHF | 0% |

0.1%

|

|||

|

16h 2m

Low

|

RWF | -4.4% |

-3.8%

|

|||

|

16h 2m

Low

|

RWF | 13.9% |

12%

|

|||

|

16h 2m

Low

|

EUR | 291.5K |

280K

|

|||

|

16h 2m

High

|

EUR | 6.9% |

6.8%

|

|||

|

16h 2m

Low

|

GEL | 0.5% |

0.9%

|

|||

|

16h 2m

Low

|

GEL | 0.01% |

0.2%

|

|||

|

16h 2m

Low

|

HUF | 52.3 |

52.7

|

|||

|

16h 2m

Low

|

PLN | 48 |

47.5

|

|||

|

16h 2m

Low

|

TRY | 50 |

50.1

|

|||

|

16h 17m

High

|

EUR | 51.4 |

50.8

|

|||

|

16h 32m

Low

|

CZK | 46.2 |

46.7

|

|||

|

16h 32m

Low

|

KZT | 0.7% |

0.5%

|

|||

|

16h 32m

Low

|

KZT | 9.1% |

9.2%

|

|||

|

16h 32m

High

|

CHF | 45.2 |

45.5

|

|||

|

16h 47m

High

|

EUR | 50.4 |

50

|

|||

|

16h 52m

High

|

EUR | 46.2 |

44.9

|

|||

|

16h 57m

High

|

EUR | 41.9 |

42.2

|

|||

|

17h 2m

Low

|

ILS | -$530M |

-$450M

|

|||

|

17h 2m

High

|

EUR | 46.1 |

45.6

|

|||

|

17h 2m

Low

|

EUR | -1% |

-0.3%

|

|||

|

17h 2m

Low

|

EUR | -10.8% |

-9.7%

|

|||

|

17h 2m

Low

|

NOK | 50.8 |

51.4

|

|||

|

17h 32m

Med

|

HKD | 4.3% |

0.9%

|

|||

|

17h 32m

Med

|

HKD | 0.4% |

0.9%

|

|||

|

17h 47m

Low

|

NGN | 51 |

52

|

|||

|

18h 2m

Low

|

EUR | 5.1% |

1.9%

|

|||

|

18h 2m

Low

|

EUR | 1.2% |

1.6%

|

|||

|

18h 2m

Low

|

EUR | 0.4% |

0.2%

|

|||

|

18h 2m

Low

|

EUR | 2.87% | ||||

|

18h 2m

Low

|

EUR | 3.15% | ||||

|

18h 2m

Low

|

EUR | 3.38% | ||||

|

18h 2m

High

|

EUR | 11% |

11%

|

|||

|

18h 2m

Low

|

ZAR | 49.2 |

49.5

|

|||

|

18h 2m

Low

|

EUR | -6.2% |

2.5%

|

|||

|

18h 2m

Low

|

EUR | -1.5% |

3.2%

|

|||

|

18h 32m

Low

|

USD | 58.3 | ||||

|

19h 2m

Low

|

ILS | 3.8% |

2.3%

|

|||

|

19h 2m

Low

|

EUR | -0.9% |

-1.2%

|

|||

|

19h 2m

Med

|

TRY | -$7.34B |

-$7.1B

|

|||

|

19h 2m

Low

|

TRY | $22.57B |

$23B

|

|||

|

19h 2m

Low

|

TRY | $29.91B |

$30.1B

|

|||

|

19h 2m

Low

|

EUR | -4.7% |

7.5%

|

|||

|

19h 2m

Low

|

EUR | 1% |

1.1%

|

|||

|

19h 2m

Low

|

EUR | 0.4% |

-0.2%

|

|||

|

20h 2m

Low

|

MXN | $220B |

$208B

|

|||

|

20h 17m

Low

|

PKR | 1.7% |

0.9%

|

|||

|

20h 17m

Low

|

PKR | 20.7% |

19%

|

|||

|

20h 17m

Low

|

PKR | 14.78% |

13%

|

|||

|

20h 32m

Low

|

BRL | -$4.373B |

-$3.05B

|

|||

|

20h 32m

Low

|

BRL | $5.01B |

$6.85B

|

|||

|

20h 32m

Low

|

INR | 11.4% | ||||

|

20h 32m

Low

|

USD | 90.309K |

91K

|

|||

|

21h 2m

Med

|

MXN | 54.3 | ||||

|

21h 2m

Low

|

PKR | -PKR605.7B |

-PKR590B

|

|||

|

21h 32m

Low

|

CAD | C$65.23B |

C$64.9B

|

|||

|

21h 32m

Low

|

CAD | C$66.62B |

C$66.2B

|

|||

|

21h 32m

Low

|

CLP | 4.5% |

2%

|

|||

|

21h 32m

Med

|

USD | -$68.9B |

-$69.1B

|

|||

|

21h 32m

Med

|

USD | 0.4% |

3.3%

|

|||

|

21h 32m

Med

|

USD | $263B |

$260B

|

|||

|

21h 32m

Med

|

USD | 3.2% |

0.8%

|

|||

|

21h 32m

Med

|

USD | $331.9B |

$329B

|

|||

|

21h 32m

High

|

USD | 1781K |

1800K

|

|||

|

21h 32m

High

|

USD | 207K |

212K

|

|||

|

21h 32m

High

|

USD | 213.25K |

214K

|

|||

|

21h 32m

Low

|

ZAR | 44.235K |

43K

|

|||

|

21h 32m

High

|

CAD | C$1.39B |

C$1.5B

|

|||

|

22h 2m

Low

|

BRL | 53.6 |

52

|

|||

|

22h 2m

Low

|

SGD | 50.7 |

50.8

|

|||

|

22h 32m

Low

|

CZK | 5.75% |

5.25%

|

|||

|

23h 2m

Low

|

USD | 1.1% |

0.5%

|

|||

|

23h 2m

Med

|

USD | 1.4% |

1.6%

|

|||

|

23h 2m

Low

|

USD | 15.5M | ||||

|

23h 32m

Low

|

USD | 92B |

68B

|

|||

|

23h 32m

Low

|

USD |

30

|

||||

|

1d

Low

|

COP | 50.6 |

51.3

|

|||

|

1d

Low

|

DKK | DKK636.8B |

DKK640B

|

|||

|

1d

Low

|

MXN | 52.2 | ||||

|

1d

Low

|

USD | 5.275% | ||||

|

1d

Low

|

USD | 5.275% | ||||

|

1d

Low

|

EUR | -3.7% |

6.9%

|

|||

|

1d

Low

|

USD | 7.17% | ||||

|

1d

Low

|

USD | 6.44% | ||||

|

1d

Low

|

EUR | -13.5% |

-5%

|

|||

|

1d

Low

|

CAD | 4.244% | ||||

|

1d

Low

|

EUR | |||||

|

1d

High

|

AUD | 54.4 |

54.2

|

|||

|

1d

Low

|

AUD | 53.3 |

53.6

|

News

U.S. Construction Spending Unexpectedly Edges Slightly Lower In March

Reflecting a decrease in spending on private construction, the Commerce Department released a report on Wednesday showing U.S. construction spending unexpectedly edged slightly lower in the month of March. The report said construction spending dipped by 0.2 percent to an annual rate of $2.084 trillion in March, while economists had expected construction spending to rise by 0.3 percent.

RTTNews

|

4h 5min ago

U.S. Manufacturing Index Indicates Modest Contraction In April

The Institute for Supply Management released a report on Wednesday showing a modest contraction by U.S. manufacturing activity in the month of April. The ISM said its manufacturing PMI slipped to 49.2 in April from 50.3 in March, with a reading below 50 indicating contraction. Economists had expected the index to edge down to 50.0.

RTTNews

|

4h 8min ago

U.S. Crude Oil Inventories Unexpectedly Rebound

The Energy Information Administration released a report on Wednesday showing an unexpected rebound by U.S. crude oil inventories in the week ended April 26th. The report said crude oil inventories jumped by 7.3 million barrels last week after tumbling by 6.4 million barrels in the previous week. Economists had expected crude oil inventories to decrease by 2.3 million barrels.

RTTNews

|

4h 14min ago

U.S. Job Openings Decrease More Than Expected In March

A report released by the Labor Department on Wednesday showed job openings in the U.S. fell by more than expected in the month of March.

RTTNews

|

4h 34min ago

U.S. Construction Spending Unexpectedly Edges Down 0.2% In March

Reflecting a decrease in spending on private construction, the Commerce Department released a report on Wednesday showing U.S. construction spending unexpectedly edged lower in the month of March.

RTTNews

|

4h 39min ago

Analysis

ADP hints at another strong NFP on Friday

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: ADP hints at another strong NFP on Friday

FxPro

|

1h 27min ago

Fed’s hawkish tone risks sinking S&P500 to 4700

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Fed’s hawkish tone risks sinking S&P500 to 4700

FxPro

|

5h 0min ago

Dollar enjoys a bid; stocks concerned about a hawkish Fed

Fed meeting in the spotlight; equities under pressure; Dollar strength continues, could intensify if Fed appears hawkish; Questionable yen intervention result; more action over the next sessions? Bitcoin fights for $60k level; oil in retreat despite Middle East headlines

XM Group

|

6h 3min ago

Daily Global Market Update

Bitcoin, MetaStock, Aussie dollar, and gold fell. Oil prices dropped, Canadian dollar weakened. Ex-Binance CEO jailed. Key events: UK's 10y Bond Auction, US ADP Employment Change, Japan's BOJ Monetary Policy Meeting Minutes, Japan's Jibun Bank Manufacturing PMI, Dutch Market Manufacturing PMI, Dutch Retail Sales.

Moneta Markets

|

7h 25min ago

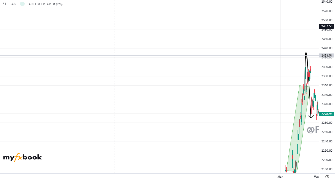

A new stage of Bitcoin's decline

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: A new stage of Bitcoin's decline

FxPro

|

8h 2min ago

Interest Rates

Market Hours

Recent Topics

3584

3 hours ago

2688

3 hours ago

124

6 hours ago

48

6 hours ago

20

6 hours ago

155

10 hours ago

29

13 hours ago

139

16 hours ago

140

19 hours ago

83

22 hours ago

Live Forex Spreads

| Brokers | EUR/USD | EUR/GBP |

|---|---|---|

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Forex Sentiment

Charts Activity

-

NZDCAD,D1 by richceoclinton 1 Hour ago

-

GBPUSD,M30 by princesajir Apr 18 at 07:52

-

XAUUSD,M30 by princesajir Apr 18 at 05:38

-

XAUUSD,M30 by MagicTraderqatar Apr 18 at 01:58

-

EURUSD,M30 by princesajir Apr 17 at 08:33